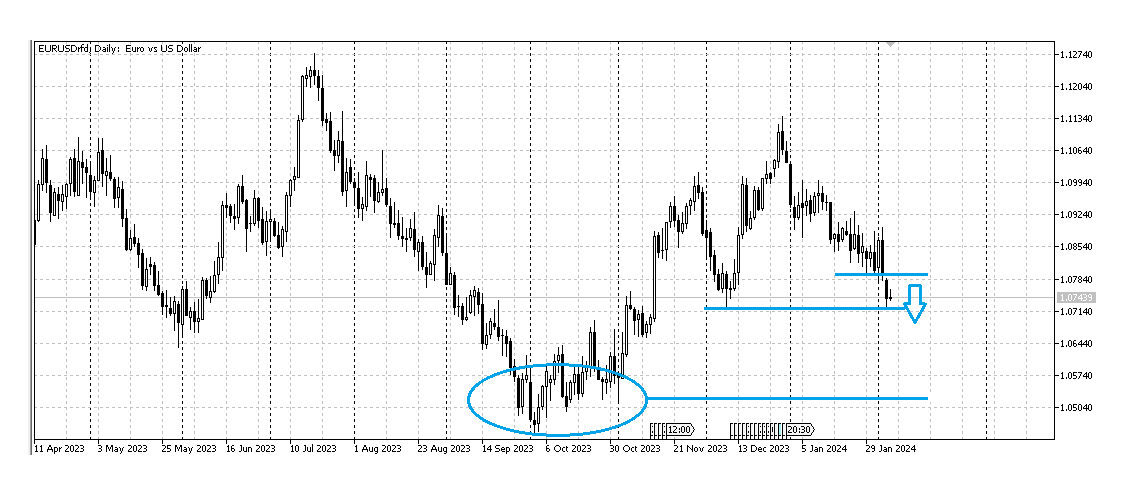

A Sell Opportunity for the Euro

The single currency is going to break through the nearest technical support at 1.07 against the Greenback. Any attempt to move below would be a good sell opportunity in EURUSD with the next possible price target in between of 1.0520 and 1.0550.

The latest portion of US jobs data literally turned the prevailing ideas about rate cut chances. The American economy offered extra workplaces of 353,000 in January and 333,000 in December, with an impressive revision of the latter number from the initially estimated 216,000. The shift was a result of an official annual calibration process. Average hourly wages added 0.6% MoM, speeding from 0.4% a month ago. Good for employees, stressful for equity investors, as pro-inflationary factors shrank bets for the Fed fund rate cut in March to only 20%. The views of futures traders at Chicago Mercantile Exchange (CME) were balanced at nearly 40-60% several days ago, even after the Fed chair Jerome Powell cooled passions for early dovish moves by saying he did "not think it’s likely" to reach a level of confidence in a rate cut decision "by the time of the March meeting to identify March is the time to do that".

The Wall St rally was challenged under added danger yet stood this local test of endurance to close the last week above 4,950 for the S&P 500 broad barometer. Even mega cap businesses became highly separated depending on details of their Q4 earnings and 2024 projections. Over the past week, Facebook owner Meta soared by 20.5%, NVIDIA stock price gained 8.4%, Amazon added nearly 8%, while Google shares dropped by 6.4%, Apple lost 3.4%. Tesla stock remained in a steep downward slope by 25% since the end of 2023. This implies a rather selective mood, with an increased attention to other firm's quarterly reports and more Fed speakers in the coming days. The US Dollar may also use a chance for further strengthening on longer rate pause estimates.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.