Inspired by Palo Alto

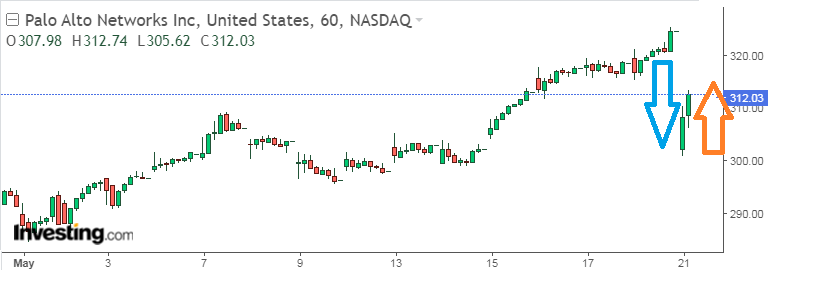

For many months, I avoided buying Palo Alto shares. I am not purchasing it right now, yet I began to consider such an opportunity for the first time in my investing life, and here is my way of thinking. You probably know the stock benefited a lot from the overall AI rally at the second half of 2023, yet badly disappointed the crowd with its forward guidance for 2024 at the end of February to waste nearly 25% of its value as a result. A step-by-step price recovery by this cybersecurity solutions business began a month ago in hopes for better Q1 numbers. Palo Alto covered the way from $265 to $320, but then was battered again by rather weak than strong billings outlook for the future. Markets focused on this aspect despite last quarter earnings beating the feared and, therefore, too modest forecasts. Sales increased by 15% to $2.0 billion, which was not bad at all, taking into consideration the preliminary expert consensus of $1.97 billion and the previous year's result at $1.7 billion only. If we discuss the business profit, then its earnings per share (EPS) came out at $1.32, beyond cautious expectations of $1.20 on average. The so-called "performance obligations rose by 23% YoY to $11.3 billion, also slightly above $11.28 billion in projections. All in all, this sounds like great progress for me.

I think that's why the stock, which initially lost about 9% of its achievements in after-hours following the report, later was bought by some part of the crowd at least to lessen the negative gap to 4% in the first two hours of regular trading today. Well, I'm still an unbiased observer, yet looking ahead to the market dynamics in Palo Alto with growing interest. The company's CEO Nikesh Arora told the public about raising customer enthusiasm for Palo Alto's comfortable platformization strategy to integrate the AI features into security measures. The next quarter forecast mentioned a good EPS range of $1.40 to $1.42, with sales figures lying within the range between $2.15 billion and $2.17 billion, both strictly in line with the $1.41 consensus. Again, Palo Alto updated its annual guidance to project its own sales range with $8.00 billion only in the middle, which was up from the previous range of $7.95 billion to $8.00 billion, and also above the consensus estimate of $7.98 billion. A good basis for potential attractiveness in the eyes of crowds, isn't it? The only sign from the negative side is that the billings outlook would be ranging from $3.43 billion to $3.48 billion for the quarter and $10.13 billion to $10.18 billion for the fiscal year, which are slightly short of expectations. So, I am ready to monitor day-by-day developments in Palo Alto's market valuation and to let you know if I finally decide to come into this investment.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.