No Disregard to Laggards, Part 3

A fast and even accelerating way up of the chief AI chip supplier NVIDIA to become the world's first $4 trillion company is not only satisfying to me. Being a major part of my broader vision of the whole tech segment, Nvidia's new and now absolute record in market caps really helped me to meet some of my target levels for previously lagging chip-related companies. Nvidia CEO Jensen Huang is reportedly planning his Beijing visit next week ahead of the official launching of its new and cutting-edge AI chip tailored especially for the Chinese market. On July 8, Financial Times described a modified version of Blackwell RTX Pro 6000 model, freshly redesigned to comply with all those scrutinized U.S. export controls measures. The additional news that NVIDIA’s Huang was going to meet US president Trump just a day before leaving for China trip should cement its pioneer AI chip status. Previously, Huang criticized new export restrictions under Trump as those barriers threatened to stop Nvidia from selling its H20 chip in the China market. A timely heart-to-heart talk could be the key to resolving the contradictions for Nvidia and a wider range of interested parties. Riding this wave, Nvidia shares not only climbed to their all-time highs around $164.50, but took the Nasdaq Composite index skyward as well to make it setting a second-straight daily closing record, now at 20,630 points. In turn, this immediately triggered a vigorous continuation of the bull rally in Advanced Micro Devices (AMD), Applied Materials (AMAT) and other global manufacturers involved in doing GPUs (graphics processing units), APIs (application programming interfaces and other parts for big data and high-performance computing).

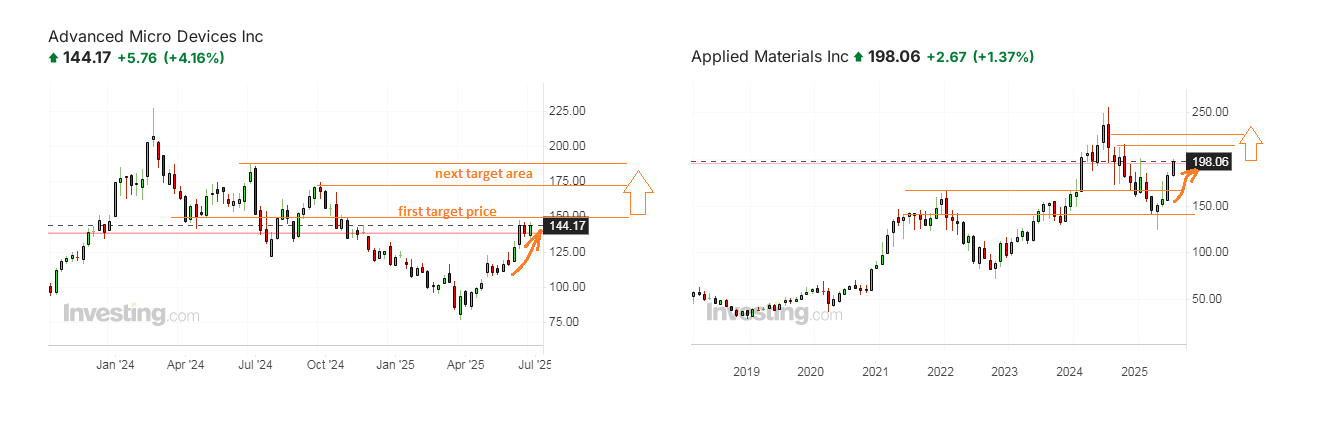

AMD occupies almost a seven times smaller niche of the global market compared to Nvidia. However, growth based on the elimination of barriers for the segment is growth for everyone. I’ve introduced you to more investment rating updates for AMD about a month ago, sharing my personal view after the first ten days of June that a breakthrough above $120 would lead AMD stock price very soon to its nearest technical target at $150 per share. During the trading session on July 10, AMD gained 4.16%, five times faster than NVIDIA on the same date, and has already been at $145.80. This marks a more than 20% gain in 30 days. So, I'm one small step away from my first goal of $150, also keeping in mind a return to $180 as my next goal.

Some analysts, however, go even further in their AMD optimism. HSBC upgraded its target price to $200, citing "a stronger-than-expected pricing power" in AMD's AI GPU lineup and "growing confidence" in the company’s "data center roadmap". What's most important, HSBC was a brokerage, which had suddenly downgraded AMD in January to nearly $100 per share, and now admits AMD’s new MI350 chips may "command higher prices than initially assumed" to perform on par with Nvidia’s Blackwell-based B200. HSBC lifted its 2026 AI revenue forecast for AMD to $15.1 billion, 57% above Wall Street consensus, as average selling prices may reach $25,000 per unit against their prior estimate of $15,000. When someone very big like HSBC is waiting for $200 and is unlikely to leave this boat before then, $180 looks like an almost guaranteed easy ride.

Meanwhile, I wrote about AMAT that as soon as it rises to $180, its further horizon would open immediately to the next nearest target price of at least $200. Just look at the charts to witness that AMAT's intraday high on July 10 was already at $199.42, with a closing price being above $198, i.e. less than $2 away from my $200 per share. Meanwhile, Goldman Sachs initiated its coverage on AMAT the same day with a Buy rating and its inner price target of $225. Am I now also expecting new price records from this semiconductor equipment maker? Yes, I am, as it is very well-diversified in gadget producers and world regions. And NVIDIA's current example of successful barrier removal is even more inspiring for AMAT and some others.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.