Broadcom Release Could Propel the Stock Rally Further

Fed chair Jerome Powell delivered remarks to the House committee on financial issues by saying that the US team of central bankers will approach interest rate cuts carefully as major economic parameters like growth and labour data look tight. However, he emphasized that the governors are going to reach confidence to launch cutting rates "sometimes this year". Of course, there was no specific message in his words, so that has not interrupted the broad uptrend on Wall Street. As a result, the S&P 500 futures slowly went to new heights, with nearest targets for March at nearly 5,200. Meanwhile, an assortment of assets, mostly consisting of AI-fuelled growth businesses, keep delivering nice surprises every day.

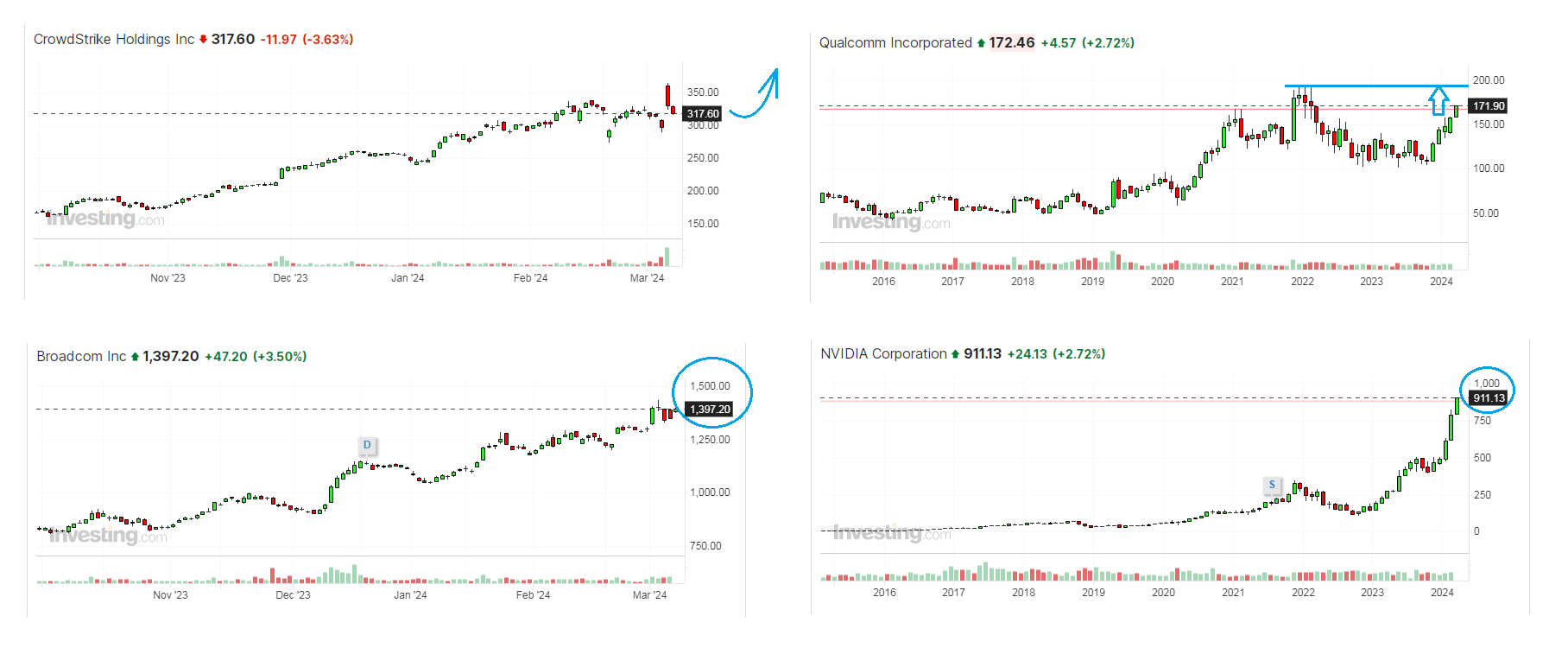

This Wednesday, CrowdStrike (CRWD) spiked by more than 20% in the opening trading gap, peaking at $365 per share. A fast wave of profit taking brought it down to now-a-support area below $320, so that I decided to add more to my stake in the stock, which already doubled its market value, as well as my profit from it, in less than five months. Even if the price comes close to $300, it will do no harm, only benefits by attracting newcomer bulls again. As one of cybersecurity leaders, CrowdStrike beat consensus numbers on Q4 earnings, giving bright guidance especially for the cloud segment that the crowd likes so much. Several large investment houses shifted their target prices for CRWD to $400 or above.

Qualcomm (QCOM) added another 2.7% in the first half an hour after the opening bell on March 7, peaking above $172 per share, yet it has at least $20 of space to the upside if one believes in repeating the all-time records of January 2021. Riding this positive wave, NVIDIA jumped to "emergency number" of $911. Going too fast, yet I expect at least $950 before I am going to run away. Right now, it looks too early to hide the nests or fold everything, yet too many guys in this market are waiting for $1000 in NVIDIA, so that smart people may start profit fixing when we are all just around the corner from this four-digit number. In March, I am going to liquidate most of my stakes in NVIDIA, before it smells like roast. Other AI stocks are good enough yet not so viral or meme assets.

Ultimately, Broadcom (AVGO) quarterly release is widely awaited after the market close on March 7 to bring even more manna from heaven on our heads. If everything will be OK with the report, this may boost other AI stocks even higher. Yet, if some weaknesses would be detected in numbers from a nearly $650 billion business, it already passed the way from $900 in early November to $1400 in this month, and keeping the stake intact looks as a reasonable solution personally for me, even in case of temporarily and sharp price adjustment. Dip buyers would not be slow to come to the rescue when NVIDIA and others continue to hit records. With all that being said, surpassing $1500 could be a dangerous red line when I would think at least of selling a good half of my stake here.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.