QUALCOMM Inc. (NASDAQ)

- By date

- Metadoro first

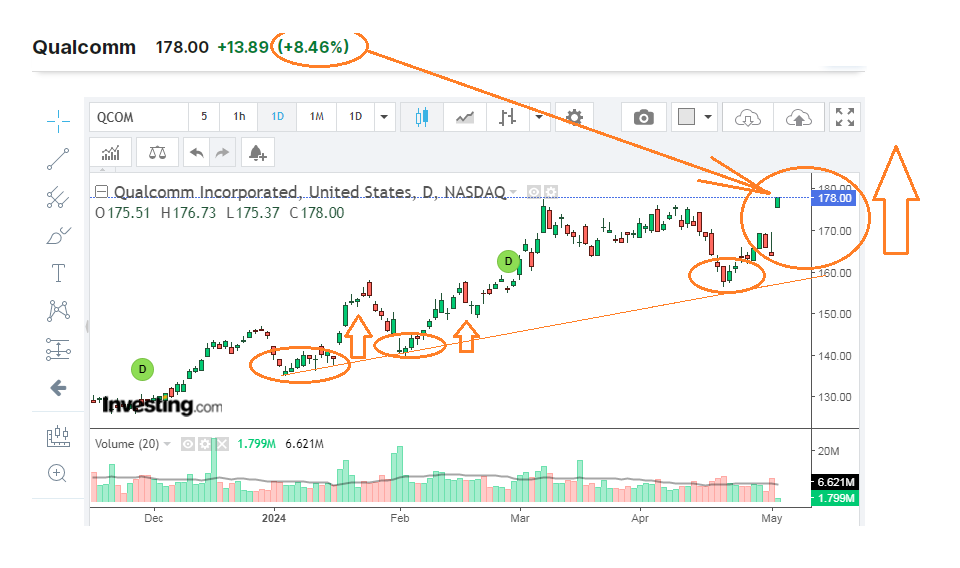

Another favourite of mine, which I first bought in early autumn of 2023, has backed both the reputation and value of my asset portfolio today. Qualcomm (QCOM) is a smartphone wireless chip-making firm. It covers the entire range of popular devices, including Apple and Samsung, and its share price soared by nearly 8.5% immediately after the opening bell this Thursday, May 2. Qualcomm's sales to Chinese producers reportedly added 40% in the last two quarters, which the company also feels is a sure sign of recovery in that market. Its Q1 financial results were mostly in line with expert projections. Revenue numbers grew by 1.2% only YoY to reach $9.39 billion, with EPS at $2.44 per share, a 13.5% better compared to Q1 2023. Yet, Qualcomm CEOs see next quarter revenue and EPS at $9.2 billion and $2.25 per share, exceeding consensus estimates of $9.05 billion and $2.17 per share, according to LSEG data. Again, this was the second consecutive quarter of growing higher, while a typical upcycle for semiconductor stocks usually lasts more than eight quarters.

"AI is driving a lot of silicon content in those devices because of the expected computational capability to run those models... users want to buy a more capable phone that can run AI," chief executive at Qualcomm, Cristiano Amon, said during a conference call. Asian customers are shifting more to premium phones. A competitive headwind from Huawei, which recently launched its 5G smartphone using Huawei's own especially designed chip, produced by Huawei's subsidiary HiSilicon, may take its share. However, the whole market is growing, especially in the more capable devices' segments where Qualcomm gets most of its money. Qualcomm's thesis for the growing recovery in China does not directly extend to iPhones, with more signs of recovery among Android customers like Oppo and Vivo. Internet of things, as well as autonomous driving, computing powers in data centers, machine learning also needs 5G technologies, which are common for Qualcomm production.

Apple report is coming tonight, and some experts raised concerns for possibly lower sales, just because of rising competition from Huawei and other locals. That's why I did not buy Apple stock in recent months, but I was sure on a more balanced bet on Qualcomm. Its income is less dependent on a particular brand, but it becomes stronger from prolonged co-operation with Apple as well, as Apple is going to use Qualcomm-designed Snapdragon® 5G modem systems for Apple devices at least until 2026. We will see the condition of Apple stock very soon, having a chance to re-estimate Apple stock price prospects. As to Qualcomm, it is already winning its own game.

QUALCOMM Inc. (NASDAQ)

| Ticker | QCOM |

| Contract value | 100 shares |

| Maximum leverage | 1:5 |

| Date | Short Swap (%) | Long Swap (%) | No data |

|---|

| Minimum transaction volume | 0.01 lot |

| Maximum transaction volume | 100 lots |

| Hedging margin | 50% |

| USD Exposure | Max Leverage Applied | Floating Margin |

|---|