Western Digital Corp. (NASDAQ)

- By date

- Metadoro first

As the winter season of corporate earnings is over, and the first (banking) segment would open a series of new quarterly reports only in two weeks on Wall Street, I just set myself a simple goal of closely watching some biggest intraday movers. Although, no great discoveries were made, I briefly took five stocks in pencil.

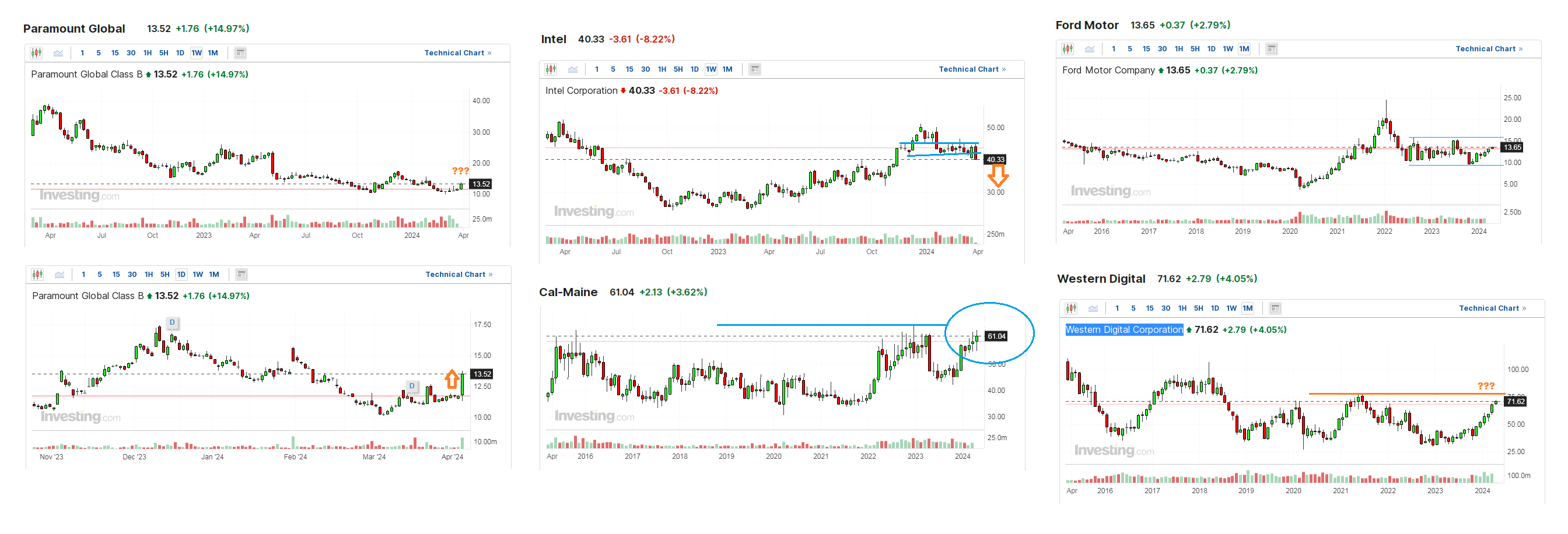

Paramount Global (PARA) soared by nearly 15% during the regular trading session on April 3 to follow a media leak that the entertainment conglomerate with its famous film and TV studio ultimately took a deal offer from Skydance Media. The merger may include all of Paramount, with Nickelodeon, CBS and other popular cable networks to solve the financial matters without breaking up the company's assets, as it needs to reduce debts. This week's price jump was impressive, yet this sends only the first positive sign as both the company's business and the multi-month technical trend on Paramount is in decline for the last three years. This means, as a potential investor I need much more time to observe the market price developments before deciding to acknowledge such a financially suffering company as "worthy" to be added to my chosen stocks' portfolio.

Intel (INTC) share price dropped by 8.22% after the semiconductor chip manufacturer announced $7 billion in operating losses for its foundry arm business in 2023. It was the very first time for Intel to report its separated numbers from the product business, which had $11.3 billion in operating income. Intel chips are not proper ones for generative AI purposes, and so it continues to lose to rivals like Taiwan Semiconductors and Samsung Electronics, not to mention AMD and NVIDIA. I became sure once again that I was right when ignoring Intel stocks amid overall chip madness, and I even may consider Intel as an object of short selling, if the tendency would have more technical confirmations soon.

As soon as I jokingly mentioned Easter eggs investment the real chicken egg producer Cal-Maine Foods Inc (CALM) attracted attention by posting solid $3.01 of Q1 equity per share (EPS), compared to $2.11 only in consensus expectations and $0.35 in the Christmas quarter. The company is successfully withstanding a current stagnation or even partial decline in egg prices, it still benefits from reaching extremely peak levels recently. Cal-Maine Foods share price initially added more than 8% after the opening bell on Wednesday, yet it managed to hold only 3.62%, representing less than a half of immediate gains. The company's market value now clearly pretends to refresh all-time records, yet additional time is needed to make any conclusions if the intentions are serious or not.

Ford Motor Company (F) rose by 2.8% in one day after its sales reportedly added 6.8% for the last three months, thanks to growing demand for its Maverick hybrid truck. It was also up 42% YoY. Yet, the mid-term charts still show a lot of uncertainty about future prospects of Ford, and I am rather sceptical about investing in Ford or even about speculative trading for this stock at the particular moment, as flat market prevails here for the last two years.

The last but not the least, Western Digital Corporation (WDC), which offers data-storage solutions, added 4%. The company nearly doubled its market value for the last five months, after it separated its HDD (hard disk drive) and Flash divisions. I found that Western Digital's cloud revenue rose 23% YoY to provide 35% of its total sales, while also minimizing its operating expenses by 17%. Amazing results, so I would consider WDC as a possible candidate to my regular stock portfolio as well, depending on its purely technical response to an important resistance line from summer 2021.

Western Digital Corp. (NASDAQ)

| Ticker | WDC |

| Contract value | 100 shares |

| Maximum leverage | 1:5 |

| Date | Short Swap (%) | Long Swap (%) | No data |

|---|

| Minimum transaction volume | 0.01 lot |

| Maximum transaction volume | 100 lots |

| Hedging margin | 50% |

| USD Exposure | Max Leverage Applied | Floating Margin |

|---|