Broadcom Inc. (NASDAQ)

- By date

- Metadoro first

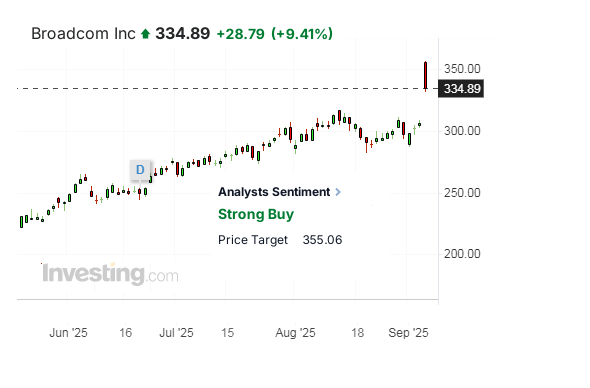

Broadcom's quarterly report became the main dish for Wall Street's feast to brush its fresh historical highs. This giant chip business with its capitalization of above $1.5 trillion and famous partners like Apple, Google, Amazon Web Services and Microsoft's Azure has risen even better than the crowd's elevated hopes. So, the initial rally in the extended hours on August 4 and then even higher before the regular session's opening on August 5, exceeded 15%. Broadcom's share price jumped even above the analyst pool's 12-month average target of $355 per share. The stock was not willing to wait that long and reached the mark in one go. After that, it was not surprising that a partial wave of massive profit taking later during the same day reduced the company's ultimate one-off performance to +9.4% "only". Apparently, many investment houses now have no choice but to raise their previous targets to at least $400 for the coming months.

Besides solid fiscal results and forward guidance, this epic jump has been made thanks to the new pact with ChatGPT designer OpenAI. OpenAI is about to launch its first in-house AI processor to ease skyrocketing demand's pressure in hunger for more computing power. This may squeeze the global dependence on Nvidia, and the point here was that the processor was being developed in close cooperation with Broadcom. Nvidia’s graphic chips are still the default choice, but Broadcom has already launched its Tomahawk Ultra networking chip and a next-generation Jericho chip to speed up AI compute, challenging Nvidia’s dominance. Broadcom's chip for OpenAI is expected to be shipped in early 2026. OpenAI allegedly wants to use the new chip internally rather than sell them to third parties like Google, Meta, Amazon or other potential users of OpenAI's products. Broadcom-made offerings for individual cloud giants are well-demanded for their generative AI model training. Meanwhile, Broadcom CEO Hock Tan pointed to some "new customer" who just secured $10 billion in orders, without naming the partner company during a conference hall, but that was probably the same case. Tan is 73 at the moment and "remains committed" to leading the company for "at least another five years".

Back to the set of dry faceless figures for the three months ended August 3, Broadcom announced EPS (earnings per share) of $1.69 on revenue of $15.95 billion vs analysts' estimate of $1.66 on revenue of $15.82B. This achievement added 64% to the profit line in terms of quarter over quarter on almost a billion dollars surplus to the revenue. Sales from the segment of semiconductor solutions, which is actually Broadcom's core business including its custom chips division, rose 57% versus the same period last year to reach $9.17 billion. Sales at the company's infrastructure software segment, which also houses the cloud computing firm VMware, rose 17% YoY to $6.79 billion for the last quarter. As to the current Q4 period, total sales are expected at $17.4 billion to beat expert bets on nearly $17 billion, as the company's CEOs touted "growth in AI semiconductor revenue to accelerate" to $6.2 billion in Q4, also above average expectations for about $6 billion.

"The company is putting a 4th AI customer into backlog", which is "more important" compared to that upside move in overall numbers were "modest", Morgan Stanley already said. Barclays analyst Tom O’Malley shared his view that Broadcom "is firing on all cylinders with a clear line of sight for growth". Broadcom has surged by more than nearly 80% since early April and performed a more threefold jump in its share price over the past two years. If our next goal of over $400 is only 20% away, then it seems like a pittance compared to the numbers, which have been listed here.

Broadcom Inc. (NASDAQ)

| Ticker | AVGO |

| Contract value | 1 share |

| Maximum leverage | 1:1 |

| Date | Short Swap (%) | Long Swap (%) | No data |

|---|

| Minimum transaction volume | 0.0001 lot |

| Maximum transaction volume | 10000 lots |

| Hedging margin | 0% |

| USD Exposure | Max Leverage Applied | Floating Margin |

|---|