A New Wave of the Rally Could Be Delayed

It feels like a new wave of Wall Street rally is now postponed. The AI-related focal point, NVIDIA, suddenly turned into a leading contributor to the lower quotes of the US stock indices. That happened after the chipmaker got a "burn notice" in the form of a subpoena sent by the U.S. Department of Justice. The federal body launched a deepening probe on claims that NVIDIA allegedly is making it harder for AI chip buyers to change suppliers and even penalizes those who do not exclusively use its AI-optimized processors, if we are to believe several whistleblowers including Bloomberg sources.

NVIDIA stock immediately lost more than 10% of its market caps to plunge from a previously sustainable footing above $120 to the current underwater below $105. The crowd is spooked even though NVIDIA representatives are calm when commenting that buyers can easily "choose whatever solution is best for them," while also adding that all of NVIDIA's recent blockbuster chips' sales convincingly showed that the firm's business "wins by merit". The range of estimates for NVIDIA's future dynamics widened, yet other chip and cloud depending stocks also fell, with AMD touching the levels below $140 after today's opening bell (but facing a more than 3.5% recovery at the moment already) and Broadcom (AVGO) practicing in diving to depths below $150 for the first time since the end of the overall market correction in early August. In my humble opinion, all of them will jump out of their corresponding lows. Needless to say, NVIDIA will surely go dry out of this absurd investigation case, so that dips in the vicinity of $100 per share, or any double-digits equity valuations for the AI monster, would be a strong buy with a very fast return of the invested capital.

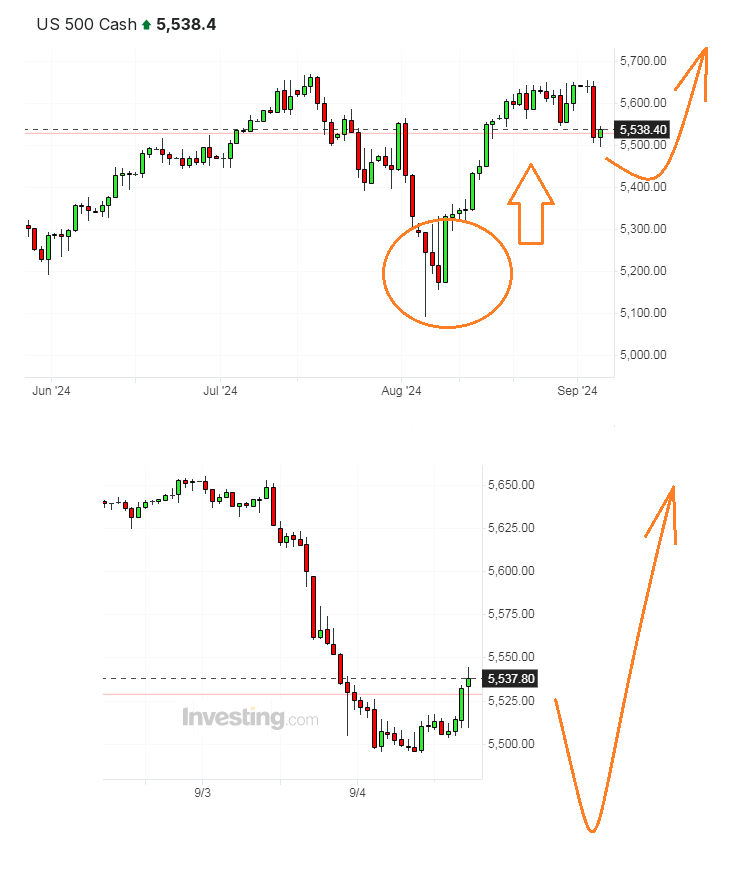

Meanwhile, the US500 broad indicator slipped to 5,500 on this background but later tried its best to keep a straight face by rebounding to 5,550 within the first two hours of the regular session in New York on Wednesday. The lower than anticipated JOLTS (Job Openings and Labor Turnover Survey) freshly marked an ongoing cooling of the U.S. labour conditions, as the number of vacancies fell from 8.184 million in June (now revised downward to 7.910 million) to 7.673 million in July, while average expert forecasts pointed to a potential of 8.090 million. When combined with the much-worried nonfarm payrolls report which is scheduled on Friday, September 6, this may be a precursor of delivering a bigger half-a-percentage-point rate cut by the Federal Reserve in two weeks, which itself is clearly positive for the bullish trend, while the facts of job market slowdown is surely negative.

However, uncertain factors continue to create nervousness on global markets, which may postpone the bullish moment of truth, which I bet will ultimately lead the S&P 500 to new historical highs above 5,850. Yet, the route may be indirect to pass through 5,300-5,400 ravines once again before a new wave of the rally would prevail, because minor reasons are stealing the crowd's attention repeatedly.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.