You Should Not Underestimate Micron

Finita la commedia. Shares of Micron Technology could no longer remain mired at their untypical double-digit price bottom where the stock landed somehow in August. I told you before, this mostly happened because of simple misunderstanding. Micron earnings in the last two quarters were strong and logically convincing, nominally exceeding consensus estimates both in the revenue and profit lines. For example, the Wall Street analysts’ pool "officially" expected Q2 EPS of $0.48 on $6.66 billion of quarterly sales vs $0.42 per share on $5.82 billions in Q1, with only about $4 billion per quarter being available on average in 2023. The actual Q2 numbers came out at $0.62 per share (+29% above average forecasts in terms of corporate profit) on $6.81 billion of revenue. However, the crowd was hungry for more. Micron's own sales projection at $7,6 billion, plus or minus $0.2 million, only added arguments to market's disappointment in mid-summer, as greedy investors were betting on a much higher update for business performance indicators of a major NVIDIA's partner in production of DRAM for graphic processing units and Blackwell AI chips.

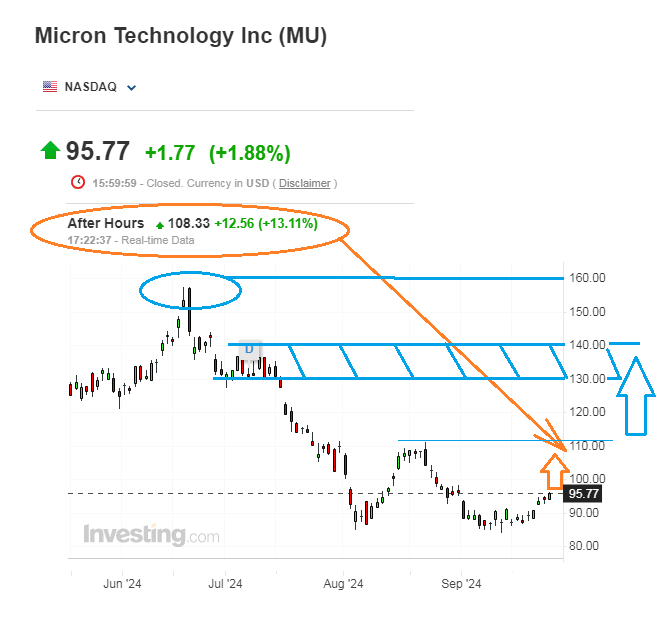

People often do not appreciate good things here and now, cherishing hopes for promises of much better progress in the future. However, the underestimation of Micron seems to be coming to an end. The company's share price jumped by more than 13% in after-hours trading on Wednesday to retest last month's important resistance area above $108 per share. The point is that Micron's CEO team notably updated its forecasts this night by saying he now expects the first quarter's sales at a much higher range from $8.50 billion to $8.90 billion, vs also rising consensus estimates of $8.28 billion. Growing memory chips demand is cited as a reason behind upbeat expectations. The company's inner forecast for adjusted EPS lies in a range of $1.74, give or take $0.08 vs average analyst estimates for $1.58. The latest quarterly results topped analyst estimates as well, after adjusted earnings for the last three months came out at $1.18 per share on revenue of $7.75 billion, due to "robust AI demand drove a strong ramp of our data centre DRAM products and our industry-leading high bandwidth memory (HBM)", compared to $1.11 a share on revenue of $7.65 billion in preliminary consensus numbers. By the way, Micron Technology is one of the only three providers of HBM chips, along with South Korea's SK Hynix and Samsung, which are needed to power generative AI technology. Micron's HBM chips were fully sold out for the 2024 and 2025 calendar years.

Based on the current fundamental and technical bullish momentum, I would expect a step-by-step recovery of Micron stock to initial price targets between $130 and $140 (meaning another 20%-30% growth) within the next three to six months, with a potential of climbing at a $160 hill, where Micron's all-time highs were detected in mid-June 2024.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.