US Natural Gas

- By date

- Metadoro first

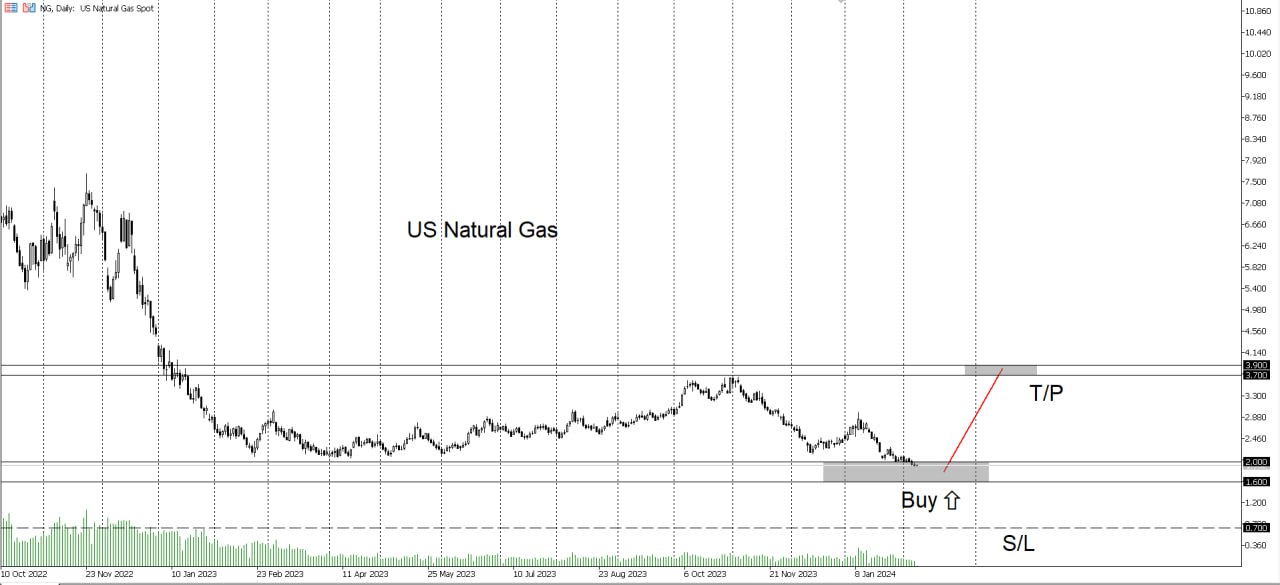

It appears that U.S. Natural Gas is poised for recovery after an extended consolidation period, presenting a classic U-turn scenario. The potential for a robust rebound is evident, reminiscent of a similar situation between September 2022 and February 2023 when prices surged by 77%.

Despite an initial rise in early November to $3.65 per MMBtu, prices retraced to $2.00. Currently, the market is witnessing a rewriting of lows, and it seems that bulls have surrendered. The current levels at $1.938 per MMBtu offer an opportunity to establish long-term upside positions, with up to 30% of the designated volume considered for use. The plan is to incrementally increase positions as prices approach $1.600 per MMBtu.

The first target for this strategy is set at $3.700-3.900, with a secondary target at $4.450, where an unclosed gap is identified. The expectation is to double profits through these operations, taking advantage of the anticipated recovery in U.S. Natural Gas prices.

| Ticker | NG |

| Contract value | 10000 |

| Maximum leverage | 1:100 |

| Date | Short Swap (pips) | Long Swap (pips) | No data |

|---|

| Minimum transaction volume | 0.01 lot |

| Maximum transaction volume | 100 lots |

| Hedging margin | 50% |

| USD Exposure | Max Leverage Applied | Floating Margin |

|---|