AI-Powered Chips Need Equipment Factories

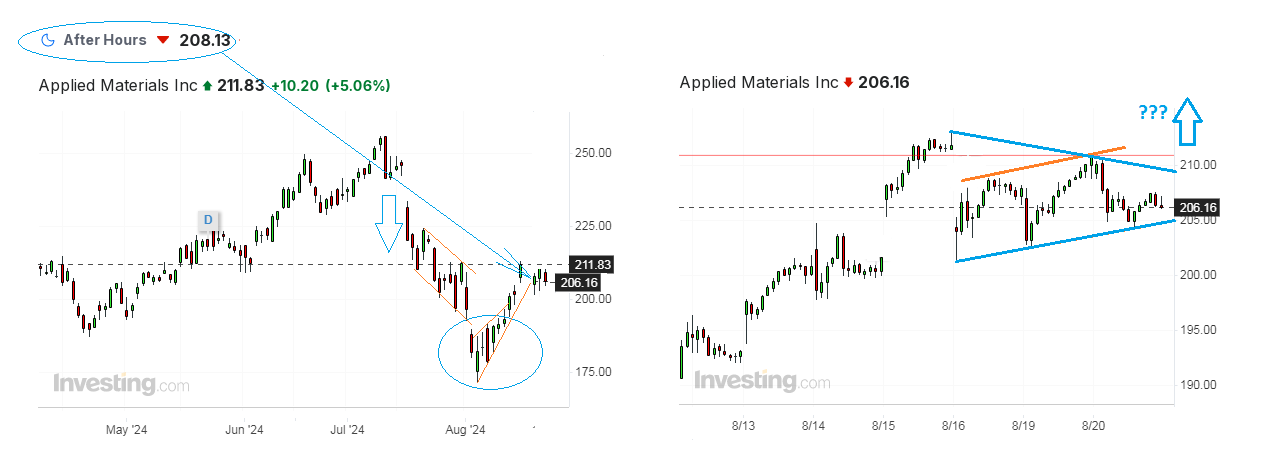

Applied Materials is on the brink of delivering another buy signal to extend its recent bounce from its unusual dips below $175. Taking profit after hitting mid-term targets above $250 per share has gone too far at some moment, mostly in sync with other tech stocks' slump. However, the manufacturer of semiconductor components for Huawei, Samsung and Apple forecasted its next quarter's revenue above Wall Street expert consensus, citing a supposed increase in AI-related demand for global chip production. The news came before the weekend, keeping concerns about the wafer fabrication equipment market limited the immediate price response because the previous buy-on-expectation phase of the new rally in AMAT already led it to as high as $211.83 just several hours before the quarterly release which came late in the night on August 15. As a result, AMAT's market value lost nearly 1.75% in after-hours trading. Further development just showed the stock attracted new groups of purchasers each time when the price was trying to touch the underground area below $205. The current formation of an almost symmetrical triangle is ending, which may quickly turn any possible next move even an inch above $211 per share into an immediate technical breakthrough with price targets of $220 at least. Yet, stronger-than-expected fundamentals would easily transform it into a more solid pattern to resume the accelerated stage of a longer-term rally in AMAT.

Coming back to the fundamentals, AMAT just reported its earnings of $2.05 per share for the 3 months ended July 28, vs $1.85 in a similar period of 2023. Its sales number reached $6.78 bln compared to $6.43 bln. Both bottom and top numbers are better than Wall Street pool projections for EPS of $2.02 on revenue of $6.54 bln. Demand for dynamic random access memory (DRAM) used in data storages is growing to account for 24% of total revenue vs 17% only one year ago. Sales of Applied Materials in China contributed nearly a third of all growth, improving from $1.73 bln to $2.15 bln YoY, despite US export restrictions. For the next quarter, AMAT forecasts its EPS within the range of $2.00 to $2.36 on revenue of $6.93 bln, plus or minus $400 million vs recent average estimates for EPS of $2.14 on revenue of $6.92 bln. For the calendar year of 2025, AMAT expects EPS of $10.15 vs the consensus number at $9.81, with "a possible path to $11 or more". Even most pessimistic investment houses now provide AMAT it with Overweight ratings, holding 12-month price targets at $250 or above. AMAT is trading with a 20% discount to this target, a nice story for bulls' attraction.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.