No Disregard to Laggards. Part 2.

Another company that is in a similar situation to AMD, both technically on the charts and fundamentally in terms of business is probably Applied Materials (AMAT). AMAT's major customers include Taiwan Semiconductors, Samsung Electronics and Intel, among others, so it is well diversified in terms of partnerships. Not being tied to only one gadget or semiconductor manufacturer, but working with different ones. AMAT's main markets include China, Taiwan, South Korea, the United States, Europe and Japan, and so it is geographically integrated into different regions of the world. AMAT also produces components for such giants like Apple, which has been slightly losing ground on the Asian market in the last year, but an important advantage of AMAT in this aspect is that AMAT is not exposed too much to any of its large partners, even including non-critical exposure to Apple. However, the recent developments in trade talks between the United States and China have given hope to shareholders of this company with its global presence in various markets.

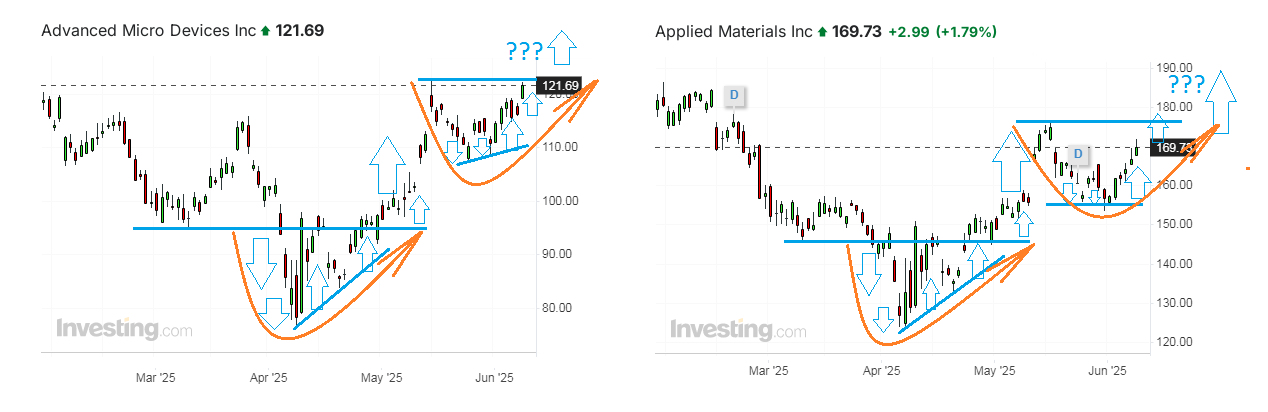

AMAT shares have not yet come so close to their May 15 peak of $176.38, which is technically similar to the $120 area for AMD. However, the technical patterns of the last five or six weeks look so similar on the AMAT and AMD charts that it seems only a matter of maybe another 10 or 20 days before the two companies reach roughly the same growth rate. AMD is up 4.8% after the weekend, while AMAT is up only 1.8% so far, but the chart analysis showed that AMAT also has more to come. As soon as AMAT rises to $180, its further horizon will open immediately to the next nearest target price of at least $200.

Still, waiting for a move higher to $180 before ramping up investments in Applied Materials seems like an important addition, as analysts at Morgan Stanley freshly upgraded Applied Materials to Equal-Weight from Underweight, citing "de-risked outlook" for China but warning that weakness in leading-edge logic and DRAM remains a concern heading into 2026. Morgan Stanley sees revenue from China and ICAPS chips (which stands for Internet of Things (IoT), Communications, Automotive, Power and Sensors), a segment catering to mature semiconductor nodes, "stabilizing through October 2025 but not recovering". Another risk is decreasing forecasts for foundry logic and DRAM (Dynamic Random Access Memory) investments, which weighed on overall estimates. Morgan Stanley now expects Applied Materials’ DRAM revenue may fall 5% in FY25 and 12% in FY26.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.