Wall Street Tries to Pinpoint Possible NVidia Successors

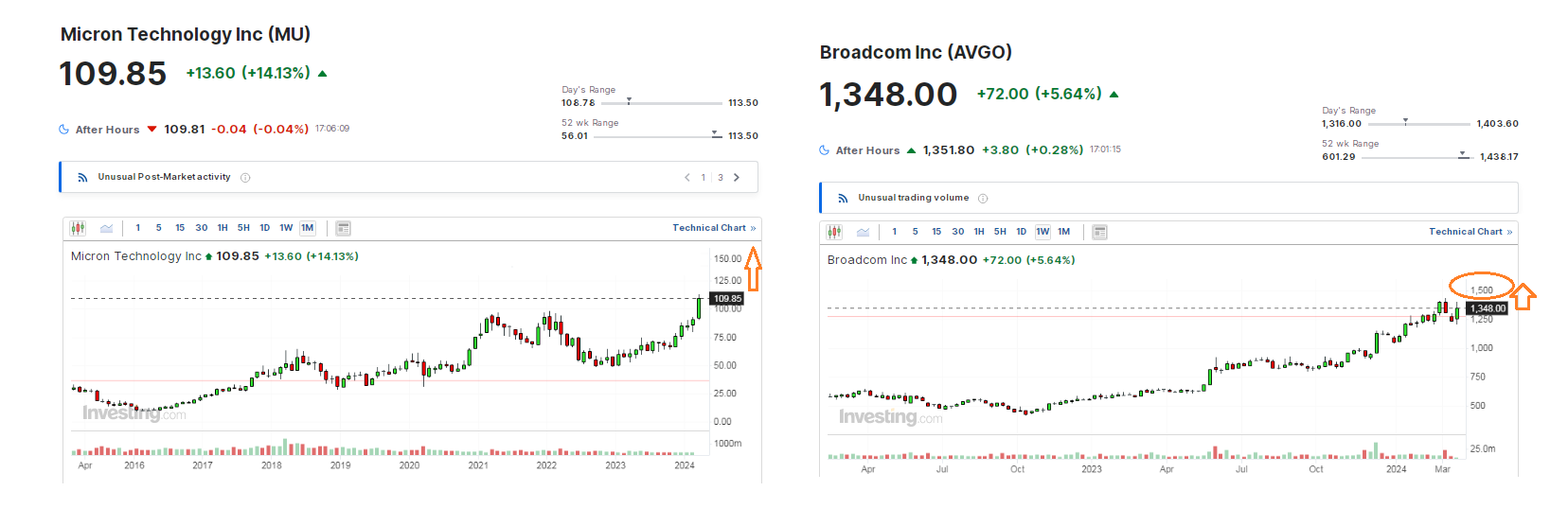

This week's jump through hoops performed by Micron Technology (MU) was like a well expected surprise for me. As I already said in late February, the stock was poised for a take off to clear the $100 hurdle. Micron's joining the NVidia party, sooner or later, would provide a stimulating effect on its market value, and that is exactly what happened when Micron surged over 15% during one day on a much-better-than-expected quarterly numbers. Its sales came out at $5.82 billion, which was 9% above the analyst pool consensus and 23% beyond the previous quarter results. It showed an EPS (earnings per share) of $0.42 instead or predicted $0.25 cent losses to demonstrate Micron handles rising cost challenges. Again, the company's management freshly shared an optimistic outlook by setting its own sales projections at $6.6 billion for the next quarter, against average expectations of nearly $6 billion.

Besides touching uncharted lands above the $110 parallel, Micron immediately got price target hikes to $124 by Mizuho Securities, to $130 by Piper Sandler and Wedbush and to a new Wall St high of $225 by Rosenblatt. These were more than serious statements from several reputable investment houses as some of them characterised the current situation as an early stage of broad-based memory demand growth or as an uptick in the memory cycle at least. "This momentum is expected to sustain, attracting a broad spectrum of investors including mutual funds, momentum and passive strategies, and retail investors," Mizuho analyst said, adding that Micron now "looks and feels like the next best AI related semi long trade after NVDA”, even though "there really is no other NVDA". They considered possible concerns about the risks of buying Micron stock after a 15-20% single-day surge as premature, and this fully coincides with my personal point of view. Moreover, investors may partially shift from NVidia to other AI semiconductor stocks, even as the new Blackwell chips by NVIDIA were presented this Tuesday.

Micron could be one of their substantial preferences, because Micron's next generation DRAM (dynamic random access memory) is now selling with NVidia's H100 and H200 AI-capable GPU (graphic processing units), and probably the same productive combination would be achieved soon with the newest NVidia's B100 chip. So, when investors think about NVidia, they should think of Micron at the same moment.

Meanwhile, another favourite of mine and of Wall St crowds, Broadcom (AVGO) added more than 5.5% to its market value after its very nice performance at the Broadcom's corporate "Enabling AI in Infrastructure" event, where Broadcom freshly confirmed its AI-related sales forecast of over $10 billion in the fiscal year of 2024, a 140% YoY jump, in sync with revealing the addition of its new AI ASIC customer. Focus on AI component supply will boost its AI sales to over $14 billion by the calendar year of 2026, its CEOs noted. Broadcom also showed expansion in high-speed Ethernet switches, which are critical for supporting an explosive growth in AI accelerator clusters. Therefore, the Bank of America's group of analysts maintained a Buy rating with $1,680 share price target for Broadcom, while Bernstein maintained an Outperform rating with a $1,600 price target, compared to nearly $1350 at the moment. Goldman Sachs group said its team came away from the event "with a better appreciation of Broadcom's strategy, competitive moat, and growth opportunity across Networking and Compute Acceleration within the context of AI". For me, just testing the next psychological resistance area at $1500 looks like a pretty conservative scenario, doesn't it?

Overall, a set of good resumes for sticking to my Buy and Hold strategy concerning not only Micron and Broadcom, but also many other related stocks like Crowdstrike (CRWD), Qualcomm (QCOM) and so on.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.