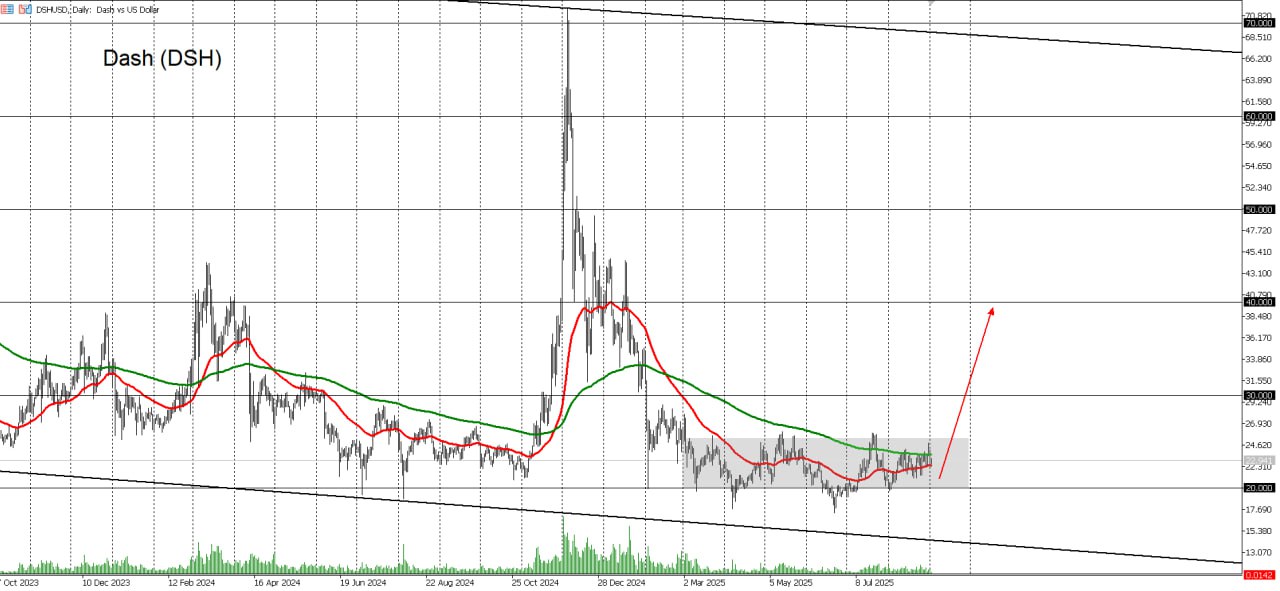

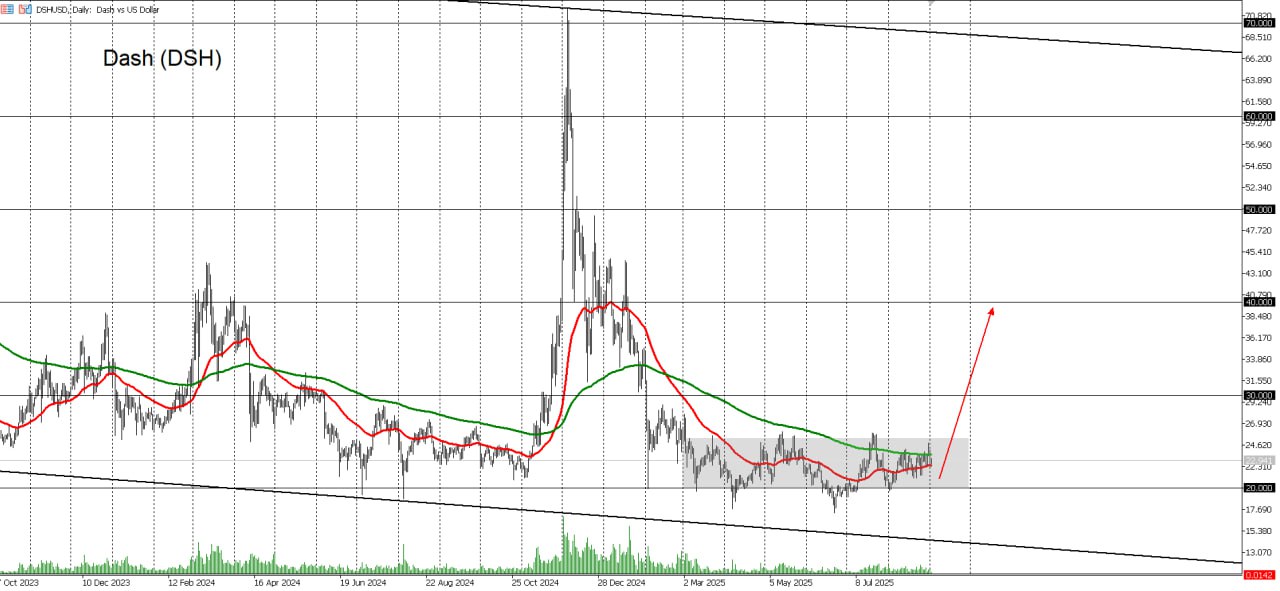

Dash (DSH) is down 4.8% to $22.90 this week, sharply underperforming Bitcoin (BTC), which is up 2.4% to $110,250. Despite the pullback, Dash has been consolidating in a tight $20–$25 range since March 2025. The last time such an extended sideways phase occurred is between June and November 2024. It preceded a powerful 232% rally to $71.62.

The current consolidation is even longer, raising the probability of another strong breakout. However, the scale of recent moves suggests fading momentum, making a more moderate target realistic. I am eyeing resistance at $40, which would still represent a robust 78% upside from current levels.