Eli Lilly and Co. (NYSE)

- By date

- Metadoro first

Eli Lilly & Co added building a $3 billion pill facility in the Netherlands to investors' ever-growing expectations. The Dutch plant will meet weight-loss oral medicine demand for European consumers avoiding trans-border tariff and logistical headwinds. This came days after Lilly announced its more than $1.2 billion expansion in Carolina, Puerto Rico for its American customers and it wants to start two new US manufacturing sites in the coming months. LLY's manufacturing footprint already includes France, Ireland, Italy and Spain, facilities under construction in Ireland and Germany.

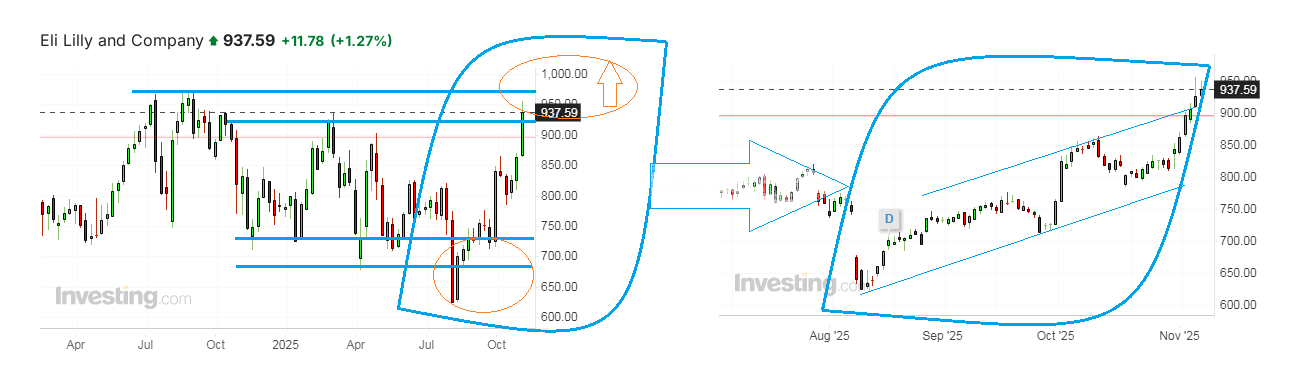

Expanding LLY's production capacities for its long-awaited Orforglipron-based pill is the best news of the week which already boosted the company's stock rally to as high at $955 only five weeks after I shared my personal "bet on at least a range from $925 to $950 per share, that is on a more than $100 of further rise in the coming months, of which at least half may occur within several weeks". And now everyone sees that the actual growth is even outpacing those daring projections for the world’s most valuable pharmaceutical company. Now there is a feeling that it runs to jump over the next mental barrier of $1000 per share, whereas previously it stopped at $972.5 about one year ago. This is even more likely given the accelerating momentum we have seen in the last month on charts. The future appendix area above historic record levels may resemble the same one near bottom prices in August.

Lilly clearly wins its competition in the field of its main Danish rival Novo Nordisk as the latter's products don't have obesity pills, only injection medication, which also reportedly may have side effects. Like a diplomat, Lilly's CEO David Ricks mentioned the Dutch Leiden Bio Science Park was chosen due to its proximity to the European Medicines Agency and the availability of a skilled and multilingual workforce. Eli Lilly's new plant will also be for oral medications in cardiometabolic health, neuroscience, cancer treatment and immunology, based on cutting-edge paperless and AI-driven processes.

As for me, I prefer swimming, playing tennis and walking outdoors a lot to taking anti-obesity pills, but I will gladly buy myself some Eli Lilly stock to finance my healthy way of life with the money from their profits. And what is your life and investment choice?

Eli Lilly and Co. (NYSE)

| Ticker | LLY |

| Contract value | 100 shares |

| Maximum leverage | 1:5 |

| Date | Short Swap (%) | Long Swap (%) | No data |

|---|

| Minimum transaction volume | 0.01 lot |

| Maximum transaction volume | 100 lots |

| Hedging margin | 50% |

| USD Exposure | Max Leverage Applied | Floating Margin |

|---|