So far, we have learned some of the essential financial assets. Now let's speak about the investment portfolio concept.

Definition of an investment portfolio

An investment portfolio refers to all your financial assets, which can include investments like stocks, bonds, mutual funds, ETFs, and other investments like real estate, art, etc., in a broader sense.

Investment portfolio and risk

As we already know, investing involves risk. Moreover, some financial instruments are riskier than others ones. Therefore, your financial goal and risk tolerance are crucial when building your investment portfolio.

Suppose your investment goal is yet far away. In that case, you may be less sensitive to adverse market fluctuations and take advantage of a general market surge. On the other hand, if you are about to retire, putting assets with a high-risk degree in your portfolio might be wrong.

Types of investment portfolios

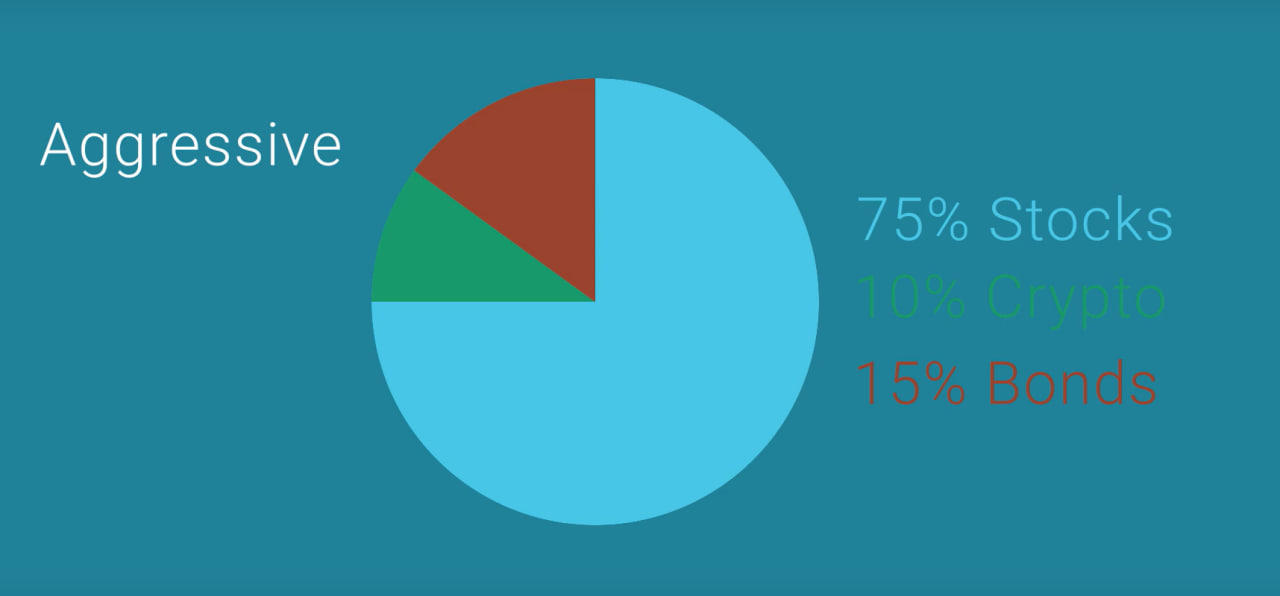

Aggressive portfolio - looking for higher growth while taking additional risks.

Example of an aggressive portfolio:

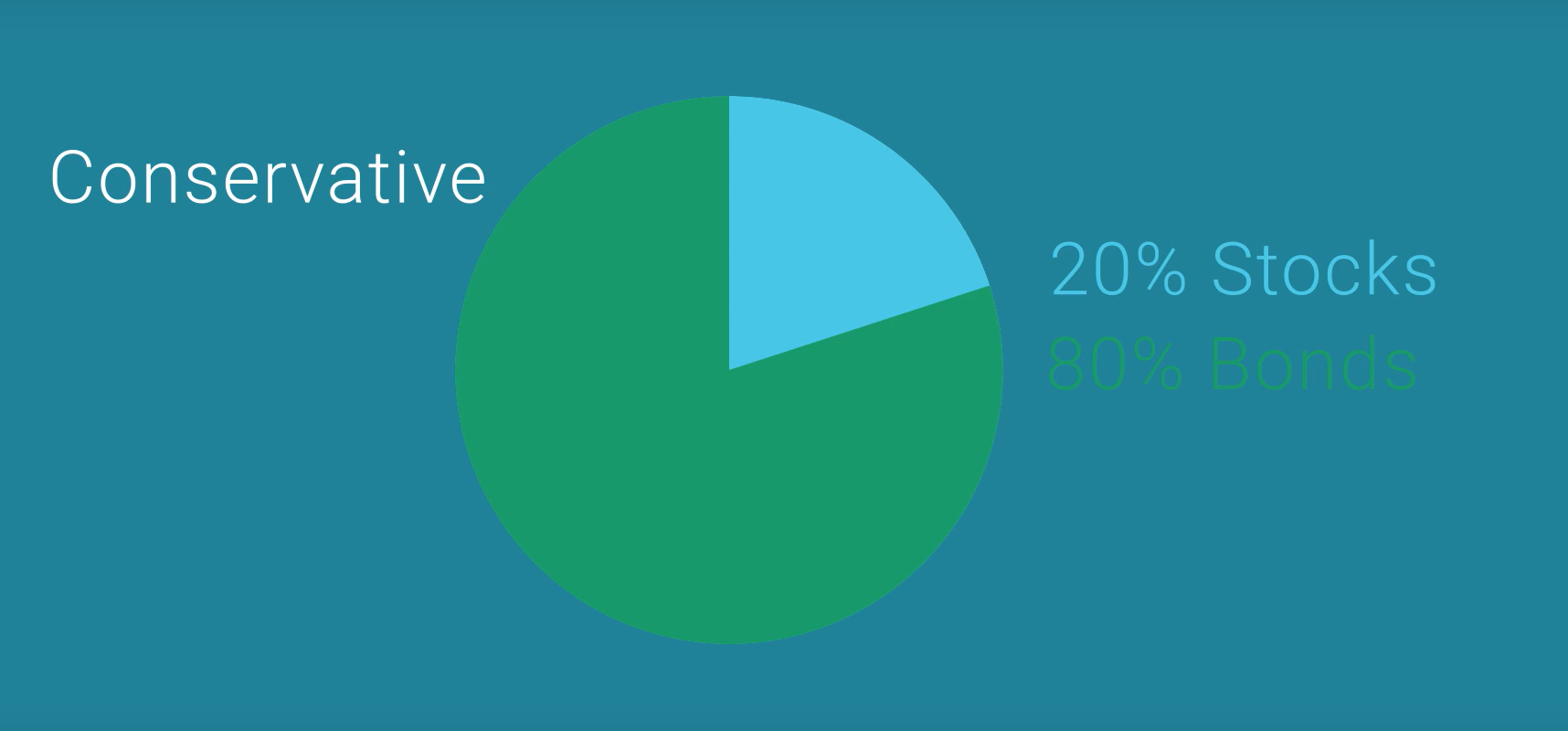

Conservative portfolio - preserves capital instead of looking for some significant gains.

Example of a conservative portfolio:

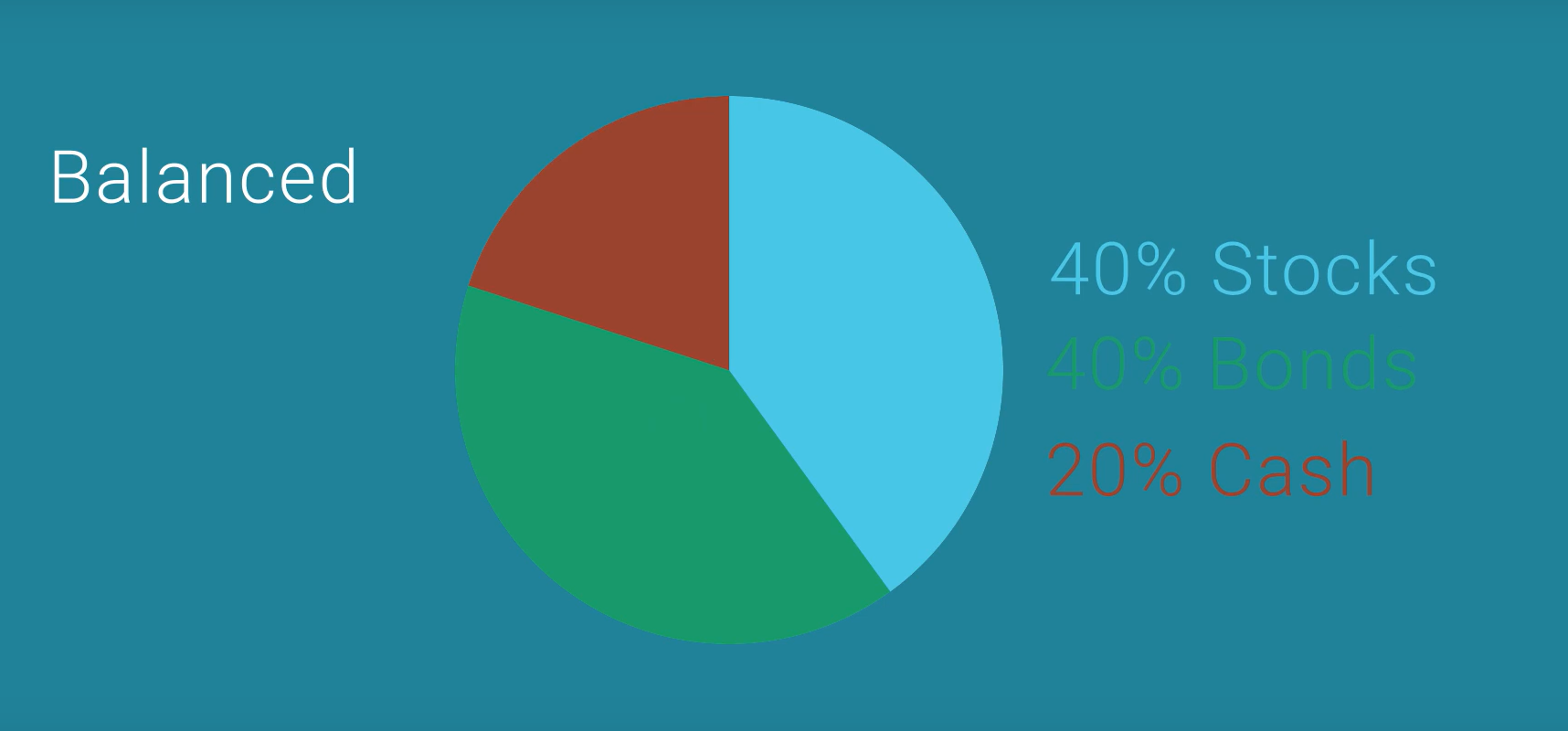

Moderate/Balanced portfolio - typically use a mixture of less and riskier assets;

Example of balanced portfolio:

Portfolio rebalancing

In time due to the approach of your investment goal or change in assets value, we might need to rebalance our portfolio to restore its initial shape.

Imagine your stock holdings grew in value over time, now weighing more within your portfolio. It may be the right time to sell some of them and add new ones.