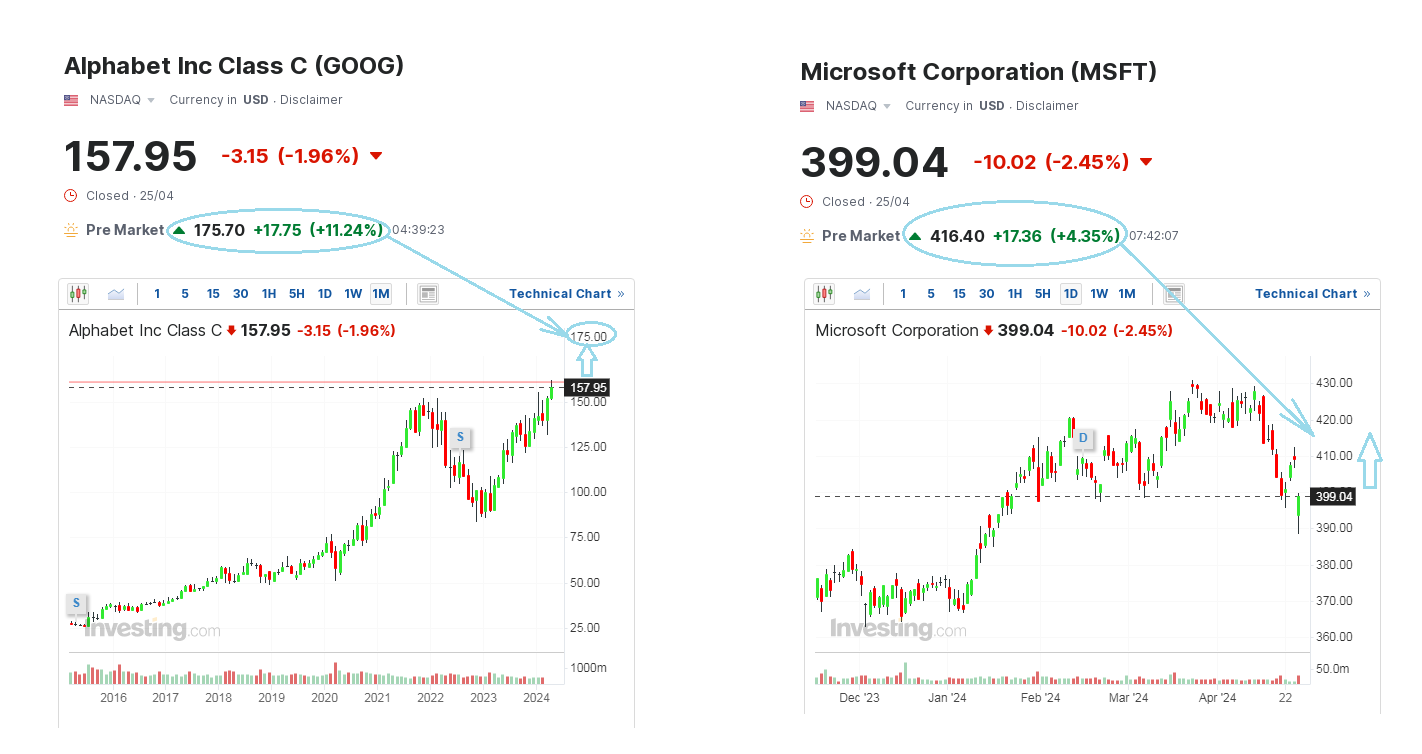

Google and Microsoft Waived Mega Cap Fears

Abundant upward moves of Microsoft (by nearly +4.5% to fully offset the previous day's 2.5% decline on Meta's 15% slump) and Google-parent Alphabet shares (by more than 11% to hit new all-time highs) in extended hours trading after long-awaited quarterly reports of the two giant companies on April 25, as well as a rapid rebound of the S&P broad market indicator from under a round figure of 5,000 points with a high closing price at 5,087.30 the same night, compellingly prove my general assumption. The bullish direction remains intact on Wall Street, unaffected by impacts of individually overbought large businesses' strong falls in market value, which including the recent double-digit drop in Meta Platforms, a 7% decline of Caterpillar and a 8% drop in IBM as a few of most striking examples. I should be happy that my analysis allowed me to avoid adding those temporary losers to my portfolio, as most rapidly declining stocks showed some weakness in their forward guidance or big investment houses just took their chance to latch on to their growing cost expenses or their performance in separate segments like it happened with a consulting part of IBM business, as it was considered not strong enough compared to the company's revenue and profit in its major hardware and computing divisions. In fact, Microsoft's CFO Amy Hood also admitted that capital expenditures would increase "materially" to help meet demand for its generative AI offerings, yet nobody cared of these kind of additional expenses as Microsoft is a producer of Chat GPT-like technologies to sell it to others, and not mostly the AI consumer, as it mostly happens in the case of Meta. This produces a big difference for the market's interpretation, so that Meta is falling, while Microsoft is growing on the same story of growth in expenses, as one may say.

All in all, some stocks are going down, but most stocks and Wall Street flagships are going up. And this is purely a normally mixed behaviour of various assets that used to accompany any reporting season, rather than global changes in the markets. With this belief, I am sure, most people in the crowd would continue to calmly and thoughtfully build further investment plans for May and summer months, while only paying closer attention to the details of particular reports' perception by the expert community and using a selective approach when forming and changing in their portfolios' composition. In this contest, the only thing, which is important in dealing with any investment strategies is not to be engaged in a "wholesale" approach of buying everything that can move, but better continue to rely on financial and technical analysis, as well as common sense and former investing experience, taking into account also the readiness of the market's majority for certain movements of specific companies at the moment.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.