No Disregard to Laggards in the Tech Rally

As there is no sole leader asset in a recovering tech race, there is still a core of mega cap assets that everybody and their dog is paying attention to. I did the same thing, so that all the key AI stocks like NVIDIA, Broadcom, Google or Microsoft are in the most significant place in my portfolio. Their price charts have turned back into the north direction faster and in a more effective way than most other tech stocks to recover after the tariff shocks of early April, attracting more free cash as well, which is entirely fair. However, it's high time to highlight here the broader market's readiness to climb higher in some of the tech segment's laggards, which have been left aside for months but become catching up in recent weeks.

There is no room for doubts about the ultimate success of data center-related infrastructure projects in the United States, not only in my head, but also, it seems, in the investment minds on Wall Street. Otherwise, one of those previous laggards, which is also one of my favorites, I mean Oracle, would not have fully recouped its plunge from $180+ to $120 with a return to $180 now again, actually provided by a nearly 50% rise over the previous 8 weeks. You should know that Oracle is planning to build a gigawatt-scale AI database giant powered by three small nuclear reactors, according to its founder Larry Ellison. Besides, Oracle, OpenAI and Japan's SoftBank are forming the soul of the joint venture, called the Stargate Project, to start building data centers in Texas and then expand to other states. It is supported by the US government, while the three companies would commit $100 billion to Stargate initially to pour up to $500 billion into the venture over the next four years.

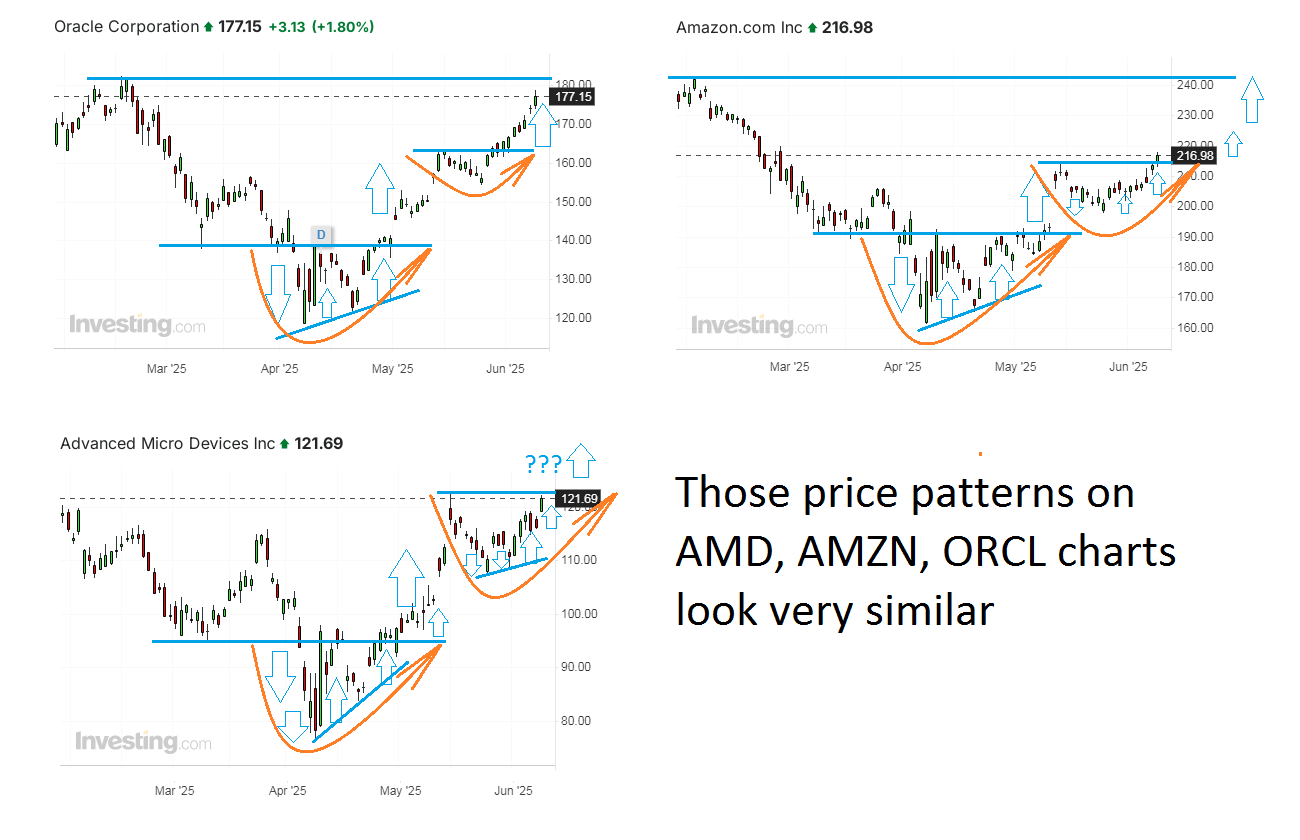

These are well known facts, but I'm just using Oracle as an intermediate example right now because Oracle share price has already recovered to their previous levels, but it has dropped almost the same dramatically like my other selected stocks, including AMD. They were unloved but then began to bounce back. I feel, they have to go by a similar path of recovering their recently much higher market potential. In particular, the chipmaker AMD has already progressed from its 2-year market price bottom below $80 to over $120 per share, soon after knocking on the newly baked support around $110. It managed to overcome temptation to slide below and jumped back to its monthly technical resistance. As late as this Monday, June 9, a similar resistance line was broken upwards on the Amazon chart, if such a comparison could be applied here. A similar picture is now also regarding Google charts, for example. Both Amazon and Google are more prosperous giants, of course, but the general market sentiment can help such companies as AMD to break its nearest barriers now, which also has fundamental reasons in case of AMD.

AMD reported solid quarterly numbers in early May. AMD's AI GPU market share is estimated at less than 10%, which is certainly far from NVIDIA's 85% share globally, but AMD is not shrinking its niche either and is even gaining momentum, with possible deal to weaken AI export control rules from US to China being a positive sign for the leading companies of the segment, including AMD. Against this background, AMD also received several rating updates from investment banks on Wall Street. As a swing failure at $110 has occurred, I see a breakthrough above $120 would lead AMD to the nearest technical target price at $150 per share.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.