Great Numbers to Make Amazon Great

Amazon stock shortly slid from $184 at before the report’s close to below $175. But, no drama. First, the current market price is only one $1.5 lower than where I bought an extra portion of Amazon in the night from July 30 to July 31. I am not sure that prices would be much lower today or next week. Moreover, there is even a high chance that the world’s most successful e-commerce business will recover to better levels already in the nearest days, as investors may focus mostly on Amazon Web Service (AWS) achievements, which are unique.

“We’re continuing to make progress on a number of dimensions, but perhaps none more so than the continued re-acceleration in AWS growth,” Amazon CEO Andy Jassy commented after the company’s cloud business collected quarterly revenue at $26.3 billion against consensus bets on $25.95 billion to generate a 19% gain in income YoY. This means Amazon’s cloud division thrives in a competitive environment of rising interest in AI-related decisions.

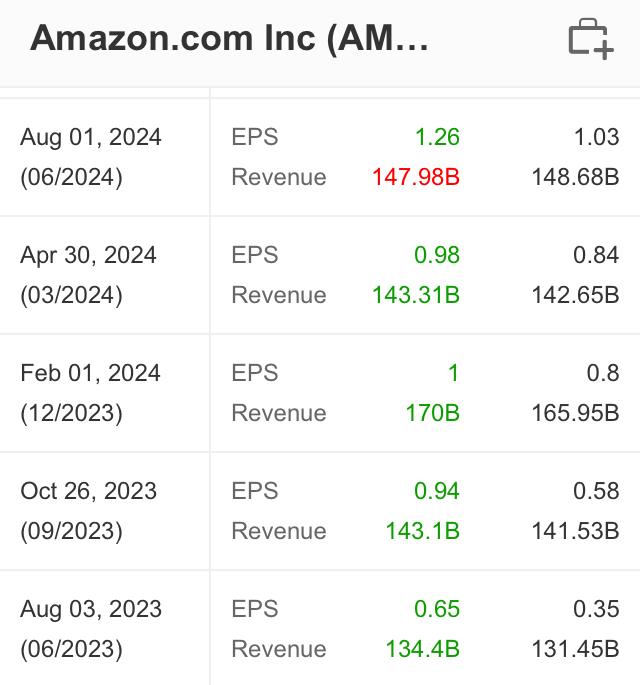

The last quarter gave $1.23 of earnings per share, which will surely increase the shine of Amazon in the eyes of investing crowds and market specialists. A small distance from $147.98 billion in revenue numbers to $148.68 on the analyst pool’s target should not confuse anybody, because Q2 revenue came out by far better than in the previous four quarters, excluding the epic record at $165.95 billion in the Christmas quarter of 2023. Current readings could not be called mixed in this context, as they were very close to perfect fundamental scenarios.

Amazon’s only “fault” is its shy projection for Q3, as company’s CEOs predicted sales growth to the range between $154 billion and $158.5 billion vs Wall St analysts’ strongly overheated hopes for $158.24 billion on average. But, too greedy estimates do not mean that great numbers are not great, or the company should be ashamed for a more realistic view on its own ever-climbing results.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.