What Is a New Range for Netflix?

18.9 million new Netflix subscribers in the Christmas quarter raised the share price of my favourite and the world's largest streaming entertainment service to just a finger's touch from the four-figure mark of $1,000. With all my love for Netflix stock, this was surely a much higher number of newly arrived customers than I personally could have hoped for, otherwise I would have left all profits untaken across my entire stake in Netflix through the whole holiday season. But as you know, instead I chose to lock in most of the previously accumulated income before the end of 2024, when Netflix looked so overvalued at over $900 per share.

Well, Netflix quotes ended up soaring much higher, I feel mostly thanks to rather limited analyst poll bets of only 9.2 million subscribers added this time. Thus, actual achievements nearly doubled average estimates, with measures of monetisation also being high enough, which was expressed in quarterly earnings of $4.27 a share on sales of $10.25 billion, instead of $4.20 a share and $10.1 billion in consensus estimates. This naturally led to Netflix's market value surging by more than 14.5% at the highest point in after-hours trading extra session on the night of 21/22 January. However, the market price only fell gradually during the next day, without facing even a small group of willing buyers along the way down, at least till the closing price settled around $950 per share.

Traders will certainly be watching the further movements until the end of the week with a rising interest. Yet, I have to say that the firm's pure income from the growing number of users was well off record values of $4.88 to $5.40 per share during the first three quarters of 2024. Netflix's advertising tier exceeded over 55% of all new sign-ups, so that this important segment grew by nearly 30% QoQ. That's remarkable, but we could also take into consideration that ad-supported service will cost $7.99 a month only, just a little bit more than $6.99 in 2024, while the costly premium package would require $24.99 per user, which is 9% up from its current pricing. As a result, the overall growth of Netflix revenue and profit may be moderated until new advertisers' contribution offsets the difference in subscription prices.

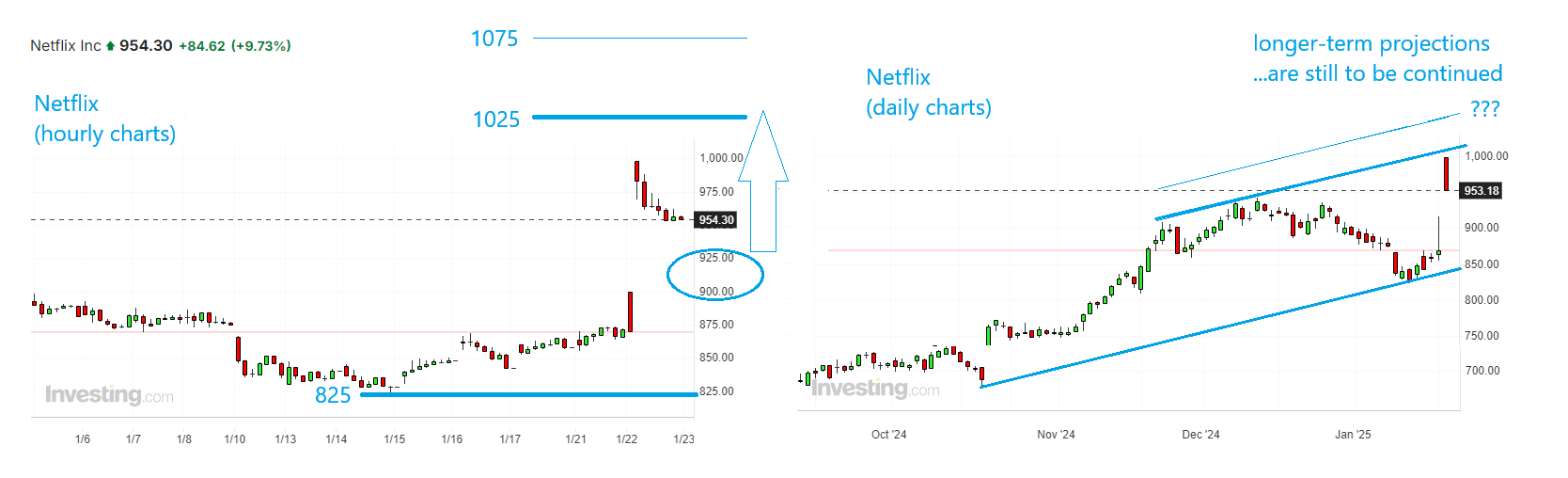

Not a problem in the medium term for a creator of popular content, including Squid Game season 2 on track, with its Carry-On action thriller joining all-time list of Netflix's top 10 shows, as well as returning seasons of the Addams Family series "Wednesday" and the supernatural "Stranger Things" plus NFL games broadcasting. I have no doubt that Netflix is entering the next stage of its Golden Age. Everything will be wonderful in accomplishing its business plans, and I believe this is going to push the stock's price into a higher range, let's say between $825 and $1,000, with possible technical spikes above $1,025 or even as high as $1,075 at some points along the upward path. However, an even steeper bullish trend may not happen.

If the market crowd sees it exactly that way, then the first big Buys for Netflix stock will start closer to $925 or even around $900, where I would be ready to add it to my personal portfolio as well. But I wouldn't be surprised to see price jumps may later turn into a subsequent decline to touch the lower third of the new corridor. And so, if one day it declines to $850 or so, I would see a lot of sense in buying more Netflix. At the same time, I'm not sure I'm ready to take prices around $1,000 right now, based on the supposed ratio of potential profit and short-term risks.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.