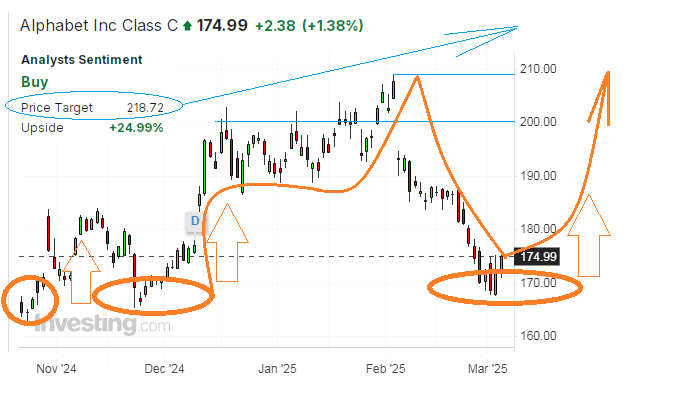

Oversold Google Bounced Off Pivotal Prices

I told you that Google stock needs a first available rationale for another bullish reversal, and so it suddenly emerged. Oversold Google happily bounced off the pivotal levels a bit below $170 per share, a super strong technical support area of late November, as soon as its parent Alphabet company announced a launch of an experimental version of a new search engine. The feature is based on Google's AI-generated summary and already available to subscribers of Google One AI Premium, with the AI, or the artificial intelligence, clearly the main two letters now in the alphabet book of any smart investor, forgive me the alphabet pun.

Google would probably soon eliminate its classic 10 blue links, which I personally loved so much, but now we have a different time with different values and perspectives, when people rarely enjoy their own choice of information for thoughtful analysis of topics at request. I just dare to hope that old good links will remain forever, only optionally. And I am ready to see another wave of the uptrend in Google stock. I would bet on an early test of levels above $200 per share in the next couple of months, which may be delayed along the way solely due to the wider Wall Street pullbacks, which recently took place in tech stocks. By the way, the Wall Street analyst pool's 12-month target for Google is still above $218 on average, which means nearly 25% free space to the upside.

As to the details of the extra feature, it can be accessed now via the results page for any search query by simply clicking on a tab labeled "AI Mode", which is put near all other options like search among images or point to locations on maps. When using the AI mood, normal links would be replaced by a search bar for asking follow-up questions. Google-produced Gemini 2.0 model promised better equipment to handle complex queries. So, this would become a crunch for the audience to be caught by the Google One AI Premium plan which costs $19.99 per month and normally provides vast cloud storage, when Google Cloud continues to grow its market share on sales at a faster speed compared to its large competitors like Amazon Web Services and Microsoft Azure. In the last quarter, Google reported a pace spike of 30% YoY on its cloud segment and would try its best to consolidate the progress. However, search-related advertising remains the core revenue source for Google. The new AI model delivers a one-two punch to hit both search and cloudy targets. Helped with its OpenAI partners, added search functions to ChatGPT as early as last October. Now Google is at least on par with Microsoft in this offer, but Google search is much more familiar for many users.

Do you need another reason to buy Google? On the same day of March 5, Alphabet’s YouTube rolled out a $7.99 per month subscription, called the Premium Light plan, which is ad-free for all videos, except music. This is another reason to compete more directly with offerings from the fast growing Netflix and struggling Disney TV. YouTube management thinks that the service has a large number of watchers who rarely use it for music and may move here from more expensive options like YouTube’s existing $13.99 Premium plan without ads at all, including for music. A separate $10.99 plan now offers ad-free music videos but other videos with ads. According to John Harding, a vice president of engineering at YouTube, the goal was to tap into a "much larger set of people" who otherwise might not consider paying for YouTube. "We didn’t feel that we really got it matching the tier for users that don’t need the music content, and so that’s where this revision comes in," said Jack Greenberg, the product director for YouTube Premium. More choice means more fun, and potentially even more money for Alphabet from YouTube. Last year, the company began testing Premium Lite in Australia, Germany and Thailand. According to Harding, early data showed that the number of users paying for Premium Lite for the first time increased, and some later upgraded to Premium. The number of people who upgraded to normal Premium was higher than the number of users who just chose a cheaper plan.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.