Cheaper IBM Has Strong Growth Fundamentals

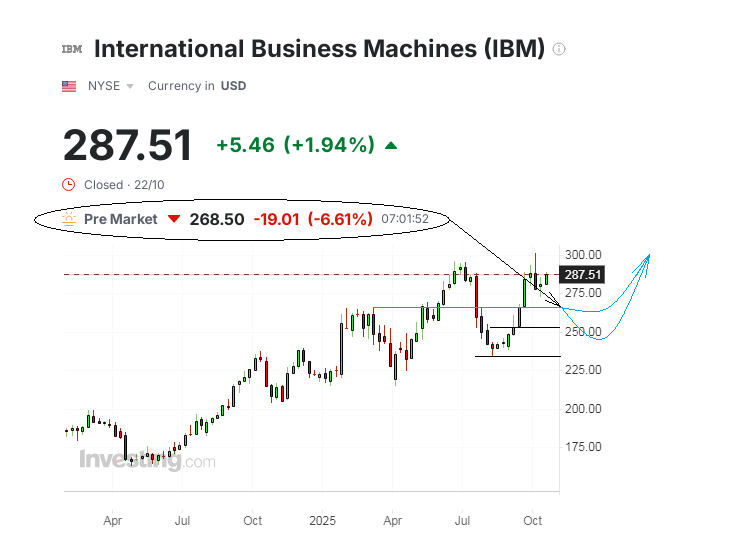

Shares of International Business Machines (IBM) were down 6.6% in extended trading on October 22 and lower in early U.S. Thursday morning. The famous computing firm delivered upbeat quarterly numbers but missed some expectations in total sales outlook. Slowing growth in the cloud infrastructure segment also contributed to the stock's corrective mood. While more than 80% of price gains over the past 18 months, including 13% of an additional rise above spring highs to fresh all-time peaks above $300 per share as recently as October 7 could perhaps be attributed to the investors' fatigue from this too speedy race of IBM. By the way, it's approximately spring high at $266.45 where the price has slid so far to test this area from above.

Yet, current fundamentals and growing AI-related hopes are still here. As a bright example, IBM’s generative AI Book of Business (the term used by the company itself to track momentum in those specific strategic areas of its business) drove Q3 growth again across nearly its entire product and service portfolio like software, hardware and consulting offerings as it grew to $9.5 billion, up $2 billion vs Q2 results. This very AI book even outweighed the economic impact of such an innovation as the System z17 mainframe upgrade introduced earlier this year.

“AI adoption is accelerating and hybrid cloud remains the foundation of enterprise IT,” IBM President and CEO Arvind Krishna commented during the conference call with analysts. However, sales growth in the hybrid cloud unit, also known as Red Hat, decelerated from 16% growth in the previous quarter to 14% within three months ended by September 30. The pace is highly expected to return to "mid-teen percentage", or "close to that level, entering 2026", Arvind Krishna said, but this issue somehow stole major attention from total Q3 sales of as much as $16.33 billion, which clearly surpasses average pool estimate of $16.09 billion, according to LSEG data.

Software revenue reached $7.2 billion, up 10%, with automation revenue particularly gaining 24% YoY. Some challenges in the consulting market previously led to public concerns that IBM’s consulting sales could show nearly zero growth, but actually the company reported its consulting revenue of $5.3 billion, up 3% percent, including a 5% pace in intelligent operations and a 2% growth in strategy and technology consulting. This reflected "growing demand for AI services as clients need help designing, deploying and governing AI at scale,” Krishna noted. If so, this can hardly be considered a weakness, just as the negative aftertaste is unlikely to be long-lasting from the slightly slower than everyone would have liked, but still very rapidly growing high-margin segments.

The stock was just overpriced before earnings and very soon will find more money flows to invest into. A replay above our target levels just over or around $300 per share that were already held in summer and later shown again in October is the base case for the end of 2025, while the current discount is still over 10% if counting from October 7 peaking price to the vicinity of $268.50 at Thursday opening bell, while the price range from $235 to $255 looks like very strong technical support on IBM charts.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.