The After Mad-Tea-Party: Coming Soon

For me, it doesn’t matter at all, if the Fed’s rate cut cycle would actually start with a small 0.25% or a double 0.5% move this Wednesday’s night. The ratio of 0.25% supporters versus 0.5% adepts is changing rapidly, while Jerry the Hatter with his Tweedledees and Tweedledums are approaching faster to their appointed Mad Tea-Party. However, the after-party trajectory and economic foundations are much more important, than a precise Sept 18 temperature of their tea.

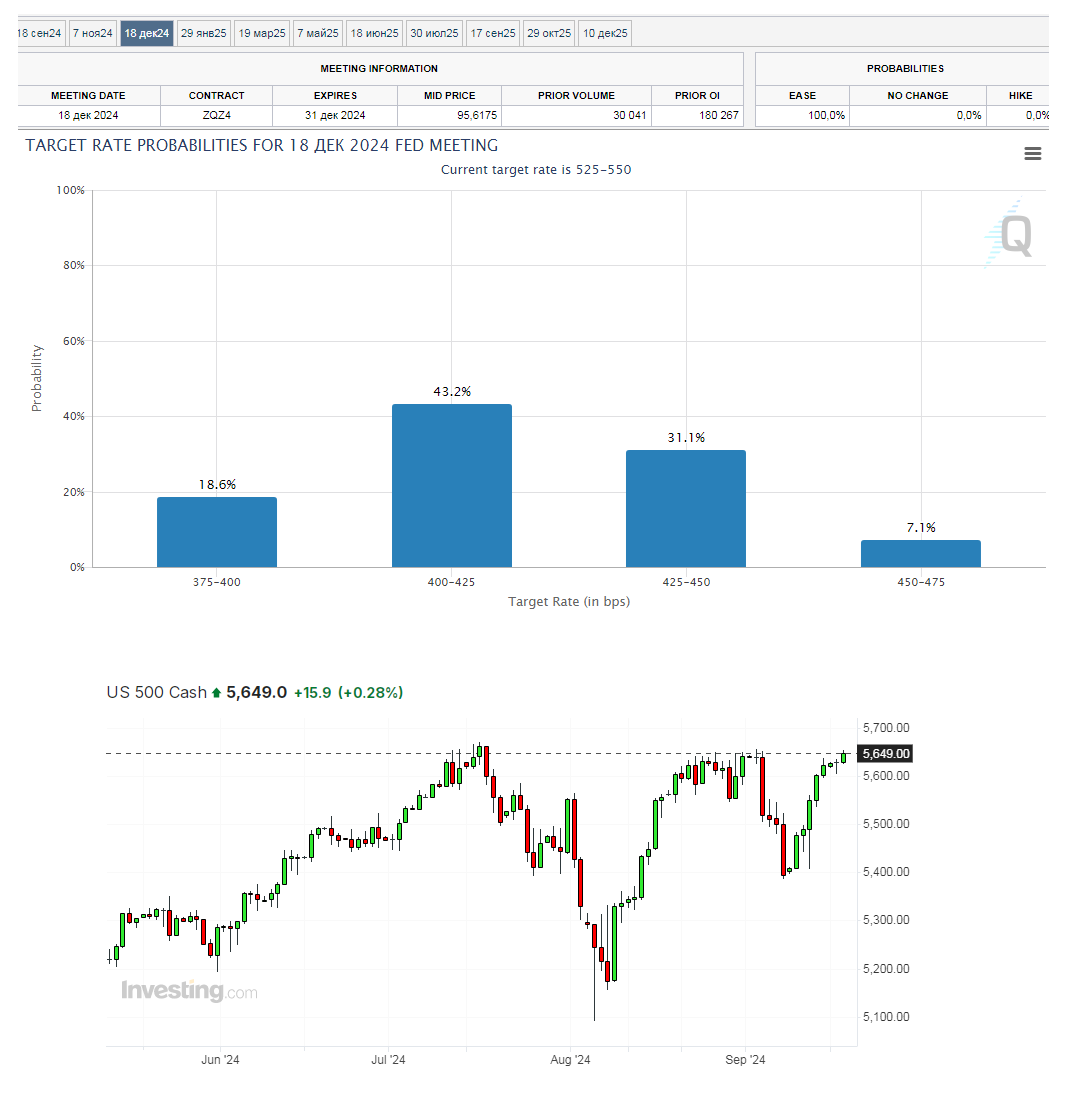

Indeed, FedWatch Tool today shows that only 7% of futures traders on CME believe in three consecutive 0.25% steps before the end of the year. Meanwhile, more than 40% are betting for a 1.25% rate cut in total at September, November plus December meetings, as nearly 20% (a giant number in this context) supports the idea of moving the current rate range of 5.25%-5.50% to 3.75%-4.00%. A 1.5% difference is the way which could be related mentally only with an emergency case like sharp jumps in unemployment or much deeper decrease of ISM services activity index, which now looks so high and safe at this height.

Well, the S&P 500 broad barometer of Wall Street is now an inch away from its 5,650 launching pad for more strength. But the majority of a bullish camp is seemingly a sort of positive doomsters, always and secretly or openly believing in a worse scenario but seeking for cheaper money to invest in market giants. An easy thing to understand, based on objective FedWatch data patterns. And no more strange, as the crowd is following such a scenario of protecting money from troubles for many months.

Is it a realistic approach? As a matter of facts, again, the National Federation of Independent Business (NFIB) just said a week ago, 37% of small enterprises in the U.S. faced historically low levels of income because of too high costs on personnel, materials, energy, lower volumes of physical sales and elevated interest rates altogether. This is even more than 35% of sufferers at the pandemic bottom in 2020. A clear evidence of non-O.K. scenario, which is perfect for the market’s growth, if this belief is based on large and quick rate cut hopes, isn’t it?

The only thing here that I personally do not believe in a 0.5%+0.5%+0.5%=1,5% path of the Fed. Therefore, I would not bet even a penny for this brave version. However, I am ready to bet a few pounds on further climbing of the S&P 500 to new peaks like 5,850 or even higher. And if you ask me why, my answer would be that I believe in the Fed’s Hatter Jerry Powell’s capacity to take more thick and poker-faced rabbits from his Mad Hat. They will feed us with their “soft landing” fairy tales, which would be far from reality, but will please the other camp of O.K.-scenario betters, led by big fund guys from The Bank of America, City etc. Thus, the “ultra-left” wing of recession believers who are betting for a 1.5% rate cut before Christmas time comes, and the “right” wing of “soft-landers”, will join together in their efforts to push the Wall Street higher and to bring me money. If you now ask for my opinion, then now I agree with both sides, ha-ha ))) as both of them are going to make me more or less relaxed two or three months with my bullish stakes on giant stocks, ETFs and indexes. And so, I love those good people from both camps with all sincerity of my independent heart.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.