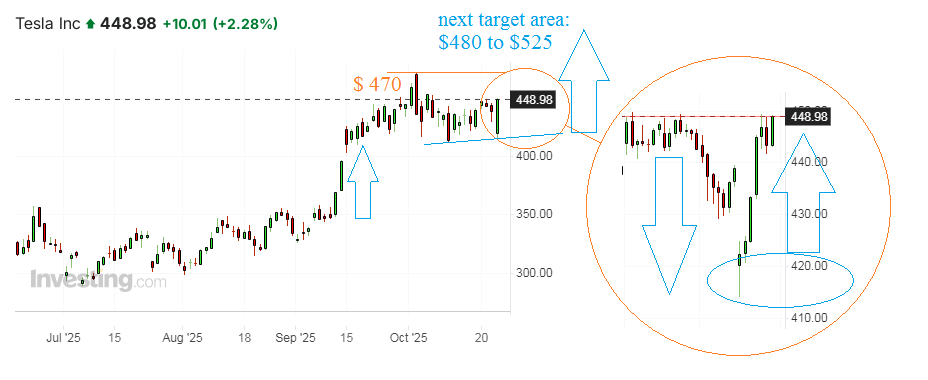

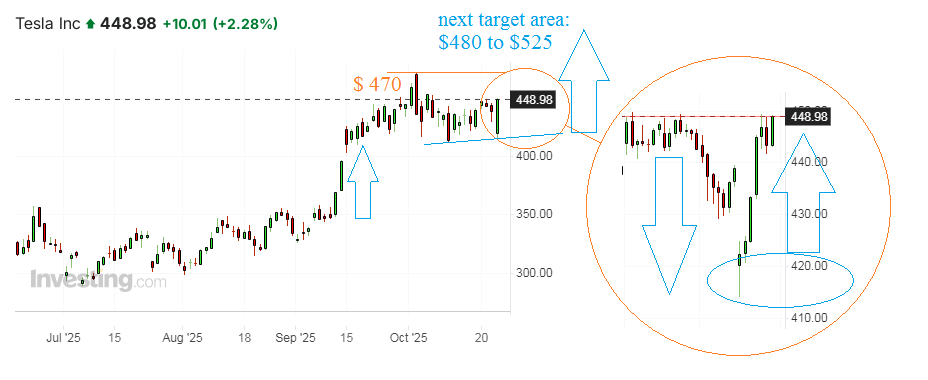

My dear friends, earlier in mid-September I told you that taking profits in growing Tesla stock without much delay was the best possible decision after its rapid upsurge. Rising in prices by more than $70 per share in only 3 trading days looked excessive. So, in the main thing, I was right, even though the major wave of mass profit taking came above $470, i.e. some higher and two weeks later. But here and now the recent market moves have changed my point of view for Tesla stock. It happily blew off enough steam already so that the crowd became eager and ready to continue on the EV maker's upside rally, having bought yesterday immediately as soon as the price touched below $415 on quarterly earnings' initially volatile interpretation. From this bottom, with losses of up to 5.5% at the point, the stock just switched into a relentless upside momentum, turning the loss into a 2.28% daily gain. It was just 0.60 cents short of touching $450, which comprehensively demonstrates currently enthusiastic market sentiment. I suggest that buying any dips close to $425 or maybe $420 would be a generous gift, as it seems that retesting $480 and then climbing to at least $525 per Tesla share is only a matter of two or three months if not just weeks.

In addition to Tesla sales exceeding Q2 by almost $2 billion with a new record of $28.1 billion, a powerful jump in EPS (equity per share) came out, being one and a half times higher from $0.33 in Q2 to $0.50 in Q3. Only very strange people could have fallen for the idea that this is a small number compared to the average expert forecast of $0.54 to start selling on it. For me, that $0.54 expert stuff just fell from the sky to create some blur around the truth that Tesla numbers were as hard as diamonds. The volume of electric vehicle shipments increased by 7% to 497,098 units compared to the same period last year. This can be partially attributed, of course, to US extra demand before the expiration of the tax credit discount of $7,500 at the end of September, but sales statistics have grown globally more or less evenly. And then there are robotaxi service expansion, the humanoid robot industry and huge battery charging network. With all this, Tesla will be ahead of its rivals, even if we take into account its higher-than-it-was-expected prices for affordable cars. I never said Tesla had fundamental weaknesses. Nothing of the sort. I only warned about the asset being momentarily overbought. That's no longer the case.