More of Consumer Staples Could Rally

As a huge fan of US retailers, I can confirm that most of my favourite stocks in this segment may rejoice in the success of their hard work during the sales season. Collected by Adobe Analytics, the latest data on spending online indicated that Black Friday generated nearly $10.8 billion this year, which marked more than 10% surplus vs 2023 records. Compared to the same day one year ago, Cyber Monday also gave a solid 7.3% rise to reach $13.3 billion. Amazon (AMZN) and Walmart (WMT) are leading in Adobe's list of the best holiday sales numbers. Therefore, it is not surprising that both giants are hitting new records in terms of their market values. Meanwhile, Amazon (AMZN) ranks first in the list of consumer discretionary ETF (XLY) contributors, with a share of 23% at the moment, but a shining Tesla just ranks second, with a nearly 18.85%. The record breaking Home Depot (HD), Booking Holdings (BKNG) and TJX (TJX), and slowly recovering Lowe's (LOW), McDonald's (MCD) and Starbucks (SBUX) are forming the backbone of a fast-growing XLY index.

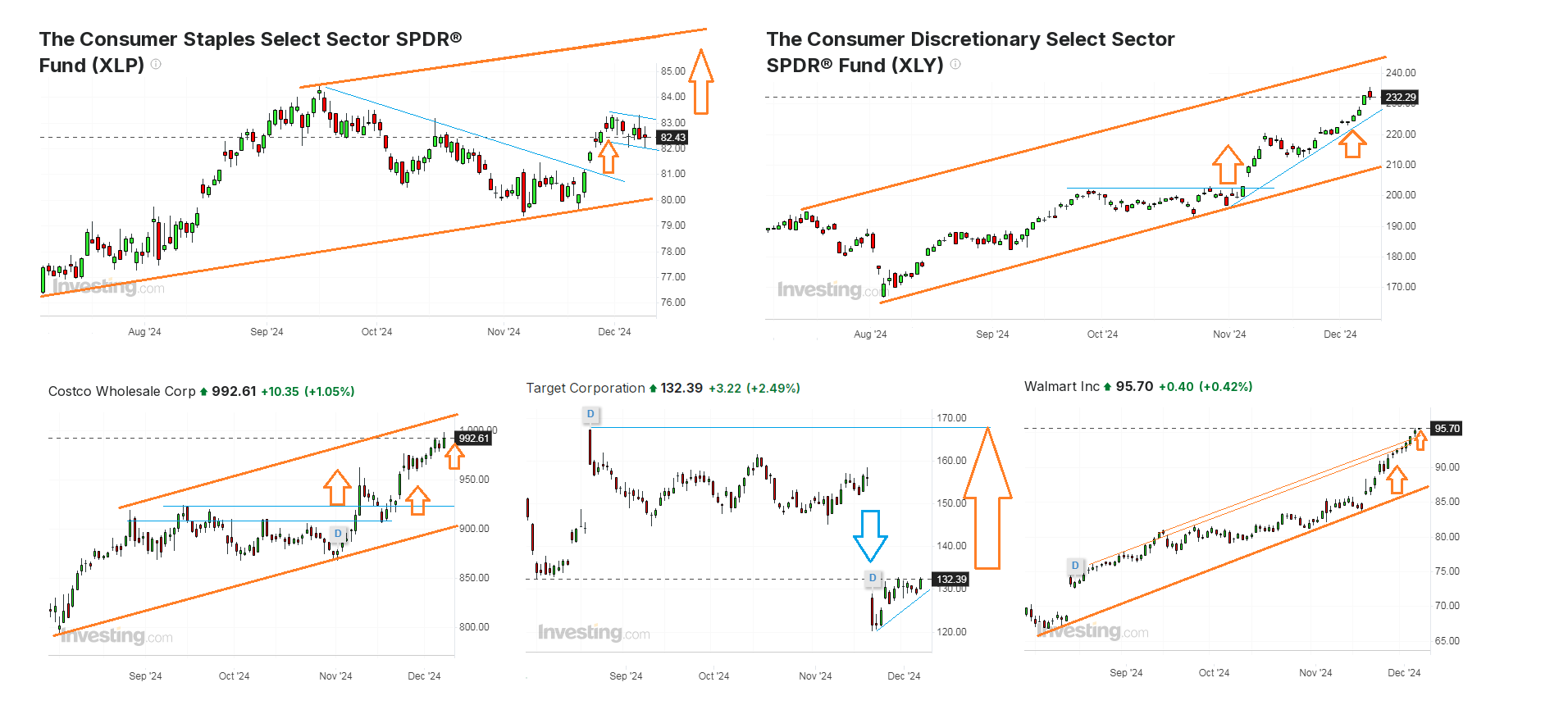

All of the above mentioned stocks deserve their rightful places in any reasonable investment portfolio for mid-term strategies, as well as Costco (COST) and Walmart (WMT) being the two headline components of a widely utilized consumer staples ETF (XLP) tracking the correspondent segment of the S&P 500. The XLP, which belongs to consumer staples, usually refers to companies that create the most essential category of products like foods, beverages, household goods and hygiene products, as well as alcohol and tobacco. Its current dynamics is still lagging behind the XLY, belonging to consumer discretionary that sell goods and services which people want, but don't necessarily need today or can't afford to buy right at the moment like electronic devices or vehicles. Yet, many sellers of consumer staples like Procter & Gamble (PG), Coca Cola (KO) and PepsiCo (PEP) can catch up soon, while the two segment leaders are relentlessly hitting their historical highs.

Walmart (WMT) is quoted around $95 per share vs nearly $75 in early September, with several investment funds even trying to adjust their outlook on the world's largest economy store chain to the upside. As an example, RBC Capital Markets freshly increased its price target from $96 to $105, sustaining its outperforming status. Walmart (WMT) is priced around $95 per share vs nearly $75 in early September, with several investment funds even trying to adjust their outlook on the world's largest economy store chain to the upside. As an example, RBC Capital Markets freshly increased its price target from $96 to $105, sustaining its outperforming status and citing Walmart's growing ad and loyalty membership income. I would also mention the AI features support for comfortable purchasing, when consumers often buy an actually wider range of goods, which they initially didn't plan to buy at all.

Another flagship of the segment, which is Costco (COST), will deliver its quarterly earnings in just three days, on December 12. This may help the whole XLP segment to climb further, as this well-known membership warehouse club is soaring by more than 50% year-to-date and trading within touching distance from a nice round figure of $1,000 per share. According to Baird analysts, the stock is going to rally to $1,075 at least in case of releasing successful Q3 profits, as an example of estimates I do agree with. Costco has reported a 8.8% annual rise in its net income three months ago, when it showed an all-time record earnings of $5.29 per share against average Wall Street consensus of $5.08, plus as much as a 18.9% e-commerce sales increase. Costco is now the fifth largest retail company in the US, which also operates in Canada, Mexico, New Zealand, China, Spain, France, Great Britain and Iceland. It has announced plans to open 29 new retail territories in fiscal 2025.

Where there is some temporary weakness are shares of Target (TGT). Despite a double-digit price drop after its quarterly report on November 20, this is still one of my favourite corporates. Much weaker than expected profit results has made this slide down fully justified, no doubt. Yet, revenue numbers did not disappoint. This means, most loyal customers visited their lovely shopping places as they used to do before, and only well-discounted prices for thousands of goods lessened the seller's profit. Some market watchers may think that Target managers have overdone with discounted items and didn't earn enough. But I feel they did exactly the right thing to save their audience to earn more money on higher prices in the future when consumers would feel better. The purchasing power of their customers will improve when interest rates by the Fed and taxes under Trump would be lower to revitalise salaries. By saving their customer base, the retail chains will benefit much more.

In a similar way, Tesla's Elon Musk adhered to discount policy for electric vehicles, even though Tesla did it in a much more expensive price segment. Tesla was offering huge discounts in China and Europe, and so what? Musk was badly criticized by the crowd of market experts, while Tesla shares were falling down to almost $100 per a piece. But, it turned out later that he was right, sales volumes recovered and went up the hill. Now, everyone who bought his or her Tesla car at a discount, will buy spare parts more than once, will buy service, electric batteries and electricity itself from Tesla's exclusive gas station networks etc. Similarly, Target will later sell much more goods to its loyal customer audience, which would remind the shopping centre as a lucky place with cheaper goods, granting bonuses for loyalty programs which these people will come to spend. People will spend even more of their own money when prices on durable goods are no longer as low as they were during tough times. Households will continue to visit the same place to buy essentials. So, shares of Target already started to bounce, from $120 to above $130. But even if Target may drop below $100, I say it will cost $200 in a less than a year, and so I'm just adding more to my stake in the company.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.