No Broader Weakness in the Market

Many in the expert community began to leave the Fed's December rate cut in question. The reasoning behind that doubt is mainly related to more bets on potentially growing U.S. economy, with a better-than-feared release of PMI (purchasing managers' index) in November and the further nominal rise in consumer sentiment. Tamed numbers provided by the Conference Board think tank showed on Tuesday that the sentiment measure increased to 111.7 points again from an upwardly revised 109.6 points a month ago vs 99.2 points only in September. This could sound like a lovely promise of increasing demand, but large retailers before the sell-off season say that they are trying their best to cut costs in line with unwillingly discounted retail price ranges.

I guess that the Fed officials know the reality on the ground better than the language of macro statistics could express it, and so the Fed would deliver another 0.25% rate cut on December 18. Nearly 65% of futures traders on interest rates agreed with this by pricing a rate cut scenario for this date. In addition, the services PMI climbed to 57.0, from 55.0 in October, which could be considered as a sign of expansion due to higher average sales price just because the services became more expensive. As to the manufacturing PMI rising from 48.5 to 48.8 points month-on-month, it's cool but every indication below 50 still means a negative slope of the industrial segment dynamics. Again, home sales are not measured in abstract points showing the lowest level of 610,000 units of new single-family homes that were sold during the previous month since December 2022, compared to 751,000 in July 2024 and 738.000 in September 2024. Here bad numbers are self-evident, for high mortgage rates prevents households from buying properties.

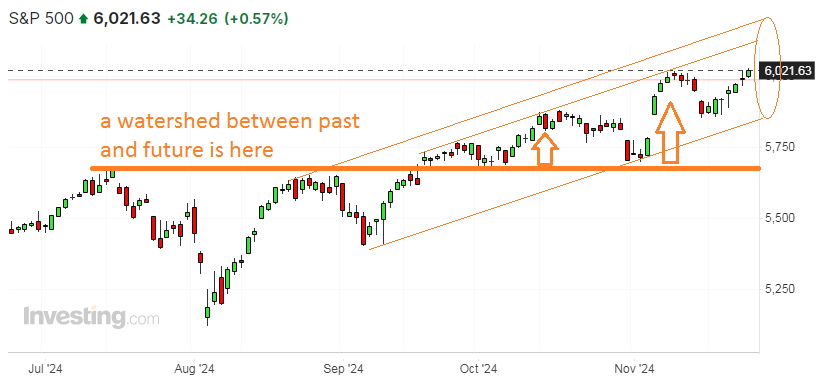

Therefore, my conclusion is that the next rate cut step is predetermined, which is a clearly positive driver for U.S. equity markets, along with lower tax hopes under Trump. As a result, we are witnessing a new all-time high above 6,020 on the S&P 500 broad market daily close. As a matter of fact, the major barometer of Wall Street never consolidated or closed above the 6,000 milestone before. Technically, a watershed line between past and future ranges for the S&P 500 came after passing and retesting 5,650. With more than 90% of companies having already reported their Q3 earnings, some of major techs may lose steam for a while, like the AI flagship NVIDIA. Some consistently good stocks, like Dell yesterday night, may slump after falling moderately short of too high consensus estimates to be suspended on the lower floors for the nearest couple of months, for example. Yet, I personally see no major weakness in their annual performance. Otherwise, stock indexes would perform in a different manner.

If someone in the crowd is buying the particular stock because of a good PMI, that's not a bad thing. If some other investors are doing the same because they rather feel that poor economic trends are aggravating to push the Fed cutting rates for growing happiness of running bulls, it's O.K. If the third group of optimists are purely betting on MAGA (Make America Great Again) policy under Trump's tax cut and deregulation guidance, I am also happy to keep a net buying position in U.S. stocks. Various reasons to remain in a bullish camp, but each of them lead to the same market stance. Just a week ago, Goldman Sachs analyst group predicted the S&P 500 to hit 6,500 points before the end of 2025. They actually shared the view of analysts at Morgan Stanley which recently said that the recent earnings growth would be broadening to continue next year “as the Fed cuts rates into next year" while "business cycle indicators continue to improve” as well. Revealing a universal superposition of two upward drivers in one forecast is another sign of growing bullish strength on the mental plane.

Meanwhile, Goldman Sachs’s target is based on US economic expansion with supposed 11% earnings growth in the course of 2025 and an approximately 5% sales growth for the index, consistent with a 2.5% real GDP growth and a deceleration of inflation to 2.4%. Goldman expects net margins expanding to 12.3% in 2025 and then to 12.6% in 2026. The Trump administration will implement targeted tariffs on imported automobiles and certain imports from China, as well as a 15% corporate tax rate for domestic manufacturers, they say, as the net impact of these policy changes "roughly offset one another”.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.