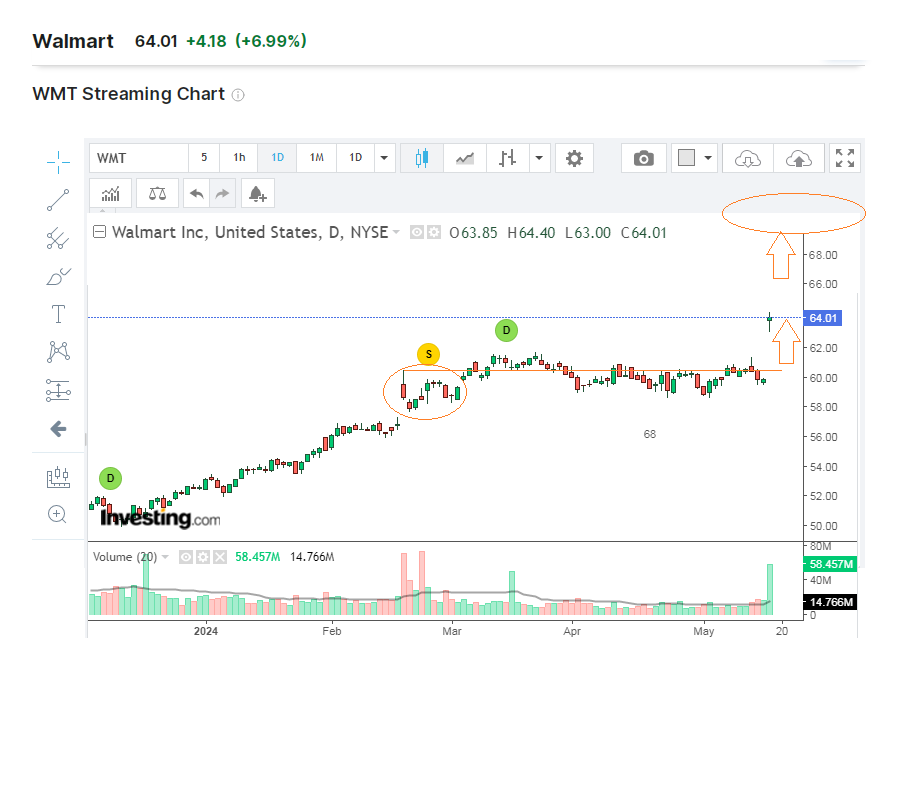

Walmart is Moving Up towards New Price Range

It was only a matter of time when Walmart stock will reset its new historical high. It was detected on February 20 at $181.35, less than a week before a 3:1 split meaning the stock price was reduced to one-third of its previous levels. This corresponds to $60.45 in a new format. The price edged slightly higher to a $61.5 area, using a residual upside momentum after the Christmas quarter report, yet this was not a real breakthrough towards the next range. And now Walmart soared to above $64 after adding 7% to its market value in a singe day of May 16. A big step for the US largest chain of economy hypermarkets, which may also prompt more smaller steps for the whole retail segment in the near future.

A background and the major reason was that the giant company's Q1 report demonstrated impressive sales growth, also with a good view to the rest of the year. Reaching consolidated revenue of $161.5 billion vs consensus number of $159.57 billion for the quarter, Walmart business declared a 6% YoY surplus, or 5.8% in constant currency calculations, while keeping intact its previously bullish signs on marginality, as its operating income added 9.6% to touch a $600 million landmark. The so-called adjusted operating income (after taking out all operating expenses like cost of goods sold, wages, depreciation etc) was up 13.7%. Continued increase in loyalty membership helped a lot.

Walmart is often perceived as a very big place where everyone walks around a huge trading floor, collecting goods in baskets. However, its e-Commerce segment was up 21%, supported well by store-fulfilled pickup and deliveries. Besides, its global ad business grew 24%. Inventories were unloaded by 2.7%, including a 4.2% drop in US Walmart stores. A commitment to frugality, spending less and sticking to a budget is what actually matters in the new reality after many inflation spikes over the last few years, and Walmart management skilfully uses the situation for the sake of its own and its customers at the same time.

The company emphasised a positive outlook for the current quarter which started in April, and it also updated the fiscal year of 2025 estimates to the upside. Even though specific numbers for the future periods were not detailed enough during the conference call, Walmart CEOs set a bullish tone for the stock's dynamics, after promising to strengthen AI features influence on sales (which I already described a lot in my February post) and bolstering its online sales attractiveness and infrastructure.

As it usually happens in such cases, some minor price adjustment is possible after the initial one-day spike to the new absolute record, yet even an update of previous price targets for Walmart by many investment houses to the levels above $70 looks too modest. I think, most of them would keep their Buy ratings even after this area would be touched, so that I feel more reasonable to have my personal expectations for more realistic targets (or one may call it dream targets) between $75 and $82.5 to approach the vicinity of the next two psychological barriers around $225 and $250, if we try to use the old-styled system of Walmart share price calculation (which would be actual if no split would happen).

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.