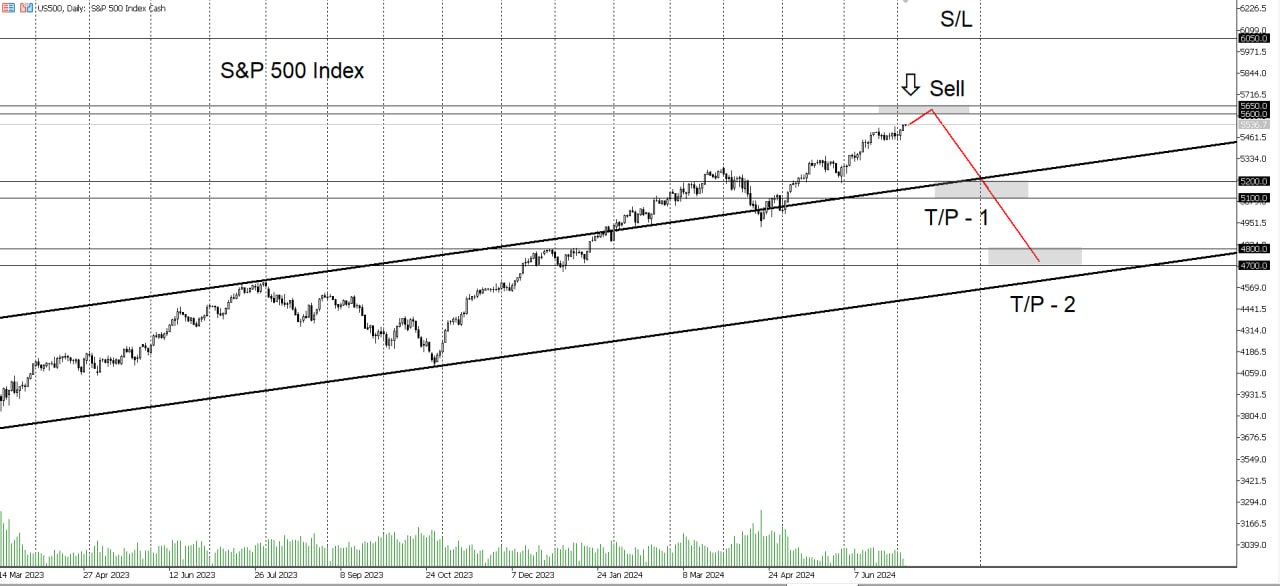

Shorting S&P 500 from 5600 points

S&P 500 index futures are moving inevitably towards a correction. Signals from the commodity and debt markets suggest a standard 5-7% correction in the following two months. Considering the slowdown of the American economy, a correction could exceed 12-15%.

The benchmark added 12.6% to 5538 points since the last correction during April 1-19. The U.S. economy grew only 1.4% during Q1 2024. According to the Atlanta Federal Reserve (Fed) GDPNow model, GDP is projected at 1.5% in Q2 2024. This is very low and does not correspond with the 16% rise of the S&P 500 this year. Thus, when the index hits the extreme target at 5600-5650 points in the coming weeks, the chances for a deep correction would rise dramatically.

A short trade could be opened from 5600-5650 points, with a stop-loss at 6050 to avoid elevated volatility. The first target is at 5100-5200 points. The second target is located at 4700-4800 points and could be achieved in case of political turbulence in the United States.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.