Price Targets for Netflix Are Higher

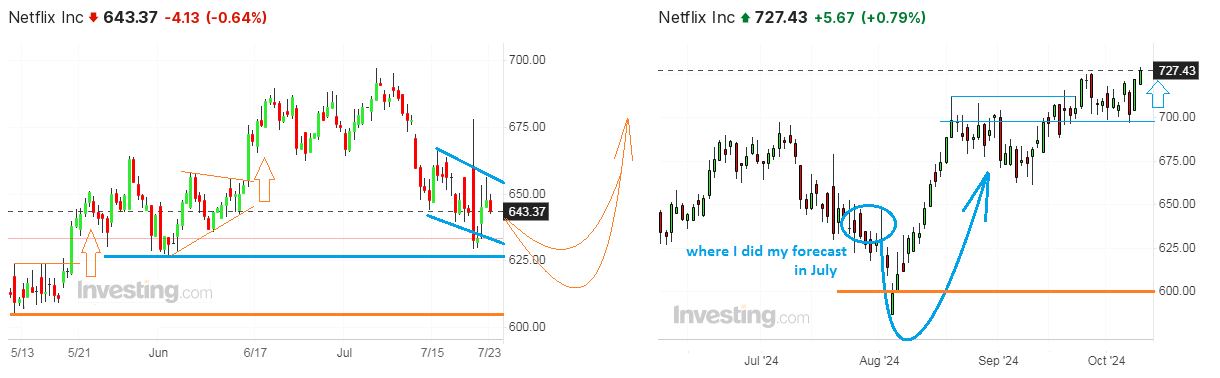

As a long-time advocate of holding Netflix stock until the asset reaches my minimal target of $800 at least, I also pointed out that my favourite streaming giant was strongly underestimated in mid-summer. I plotted an almost perfect trajectory of the further price moves, using a coloured wide arrow on Netflix chart to highlight a possible bottom area around $600, followed by a big bounce above $675. An actual low at $587 per share was indicated in the first week of August, when many mega caps were submerged by a broad retracement in the tech segment. I am happy to turn your kind attention to Netflix again, as it surges to new historical highs, now above $728.

Meanwhile, JPMorgan reiterated its Overweight rating on Netflix stock this week again, keeping its price target of $750, underlining multi-year free cash flow increase and projecting sales growth of 12% and operating income growth of 18% for the years 2025 and 2026 due to "higher profit margins and disciplined cash content management", and continuous operating margin expansion, even as the company keeps investing in diverse content library, advertising, and gaming initiatives. TD Cowen's investment management division freshly raised its price target for Netflix to $820 with a Buy rating, citing an anticipated increase in paid net member additions and its rising potential for improved monetization, predicting that advertising may represent 13% of Netflix's total revenue in 5 years. Piper Sandler upgraded Netflix stock from Neutral to Overweight, and the most sceptical Barclays downgraded the firm from Equalweight to Underweight, which still means more price increase around the corner.

The robust performance crowns a more than 90% increase in the market value of Netflix for the previous 12 months, including a 21.3% contribution when counting from the latter milestone of $600. The fundamental basis under the trend lies in raising the company's inner forecast on its revenue growth for the whole year of 2024 from solid 14% to even better 14.5%, with expectations of quarterly profits well above $5 per share in next week's announcement on October 17, compared to $4.88 in Q2 2024 and $3.73 in the same season of 2023. The net profit in April-June of 2024 increased by 44% to $2.15 billion from $1.49 billion only one year before, because of getting more money from legalised password sharing procedures. Even if Netflix's trek up the hill would not be so straight after the night of October 17th (in the way it was interrupted by waves of partial profit-taking in April and July), I bet that the road will gradually lead it up to the top anyway.

Reducing the woke message voice in new Netflix shows helped to attract more viewers outside the US and Europe. As of the end of June, Netflix had 227.65 million paid subscribers all over the world vs nearly 154 million customers of its major Disney+ rival. While waiting for the next season of Avatar: The Last Airbender blockbuster, the family audience enjoys the Garfield Movie. After making its theatrical debut in May, a new part of the world-famous story of a Monday-hating and lasagne-loving indoor cat was premiered on Netflix as part of the streamer's exclusive "pay 1 window" rights deal with Sony Pictures. Potential price hike for loyal viewers in 2025 or 2026 may offer new hopes for shareholders in the financial sense. Again, JPMorgan is mentioning high user engagement averaging around two hours per day and Netflix' world dominance in a potential of tapping into the over 500 million global connected TV households outside of Russia and China".

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.