A Perfect Time To Gather Stones

There is a time to cast away stones, and a time to gather stones together. This important scriptural truth applies not only to eternal matters of a human heart and a human soul, threats of world wars or efforts of building a peaceful and better future, curses or blessings transmitted, but also to a lot of prosaic nuances of material life, including market situations In certain circumstances as well. Many of the stones that we generously casted away earlier this spring in the form of investments can now be collected and gathered together to form an exclusively profitable composition.

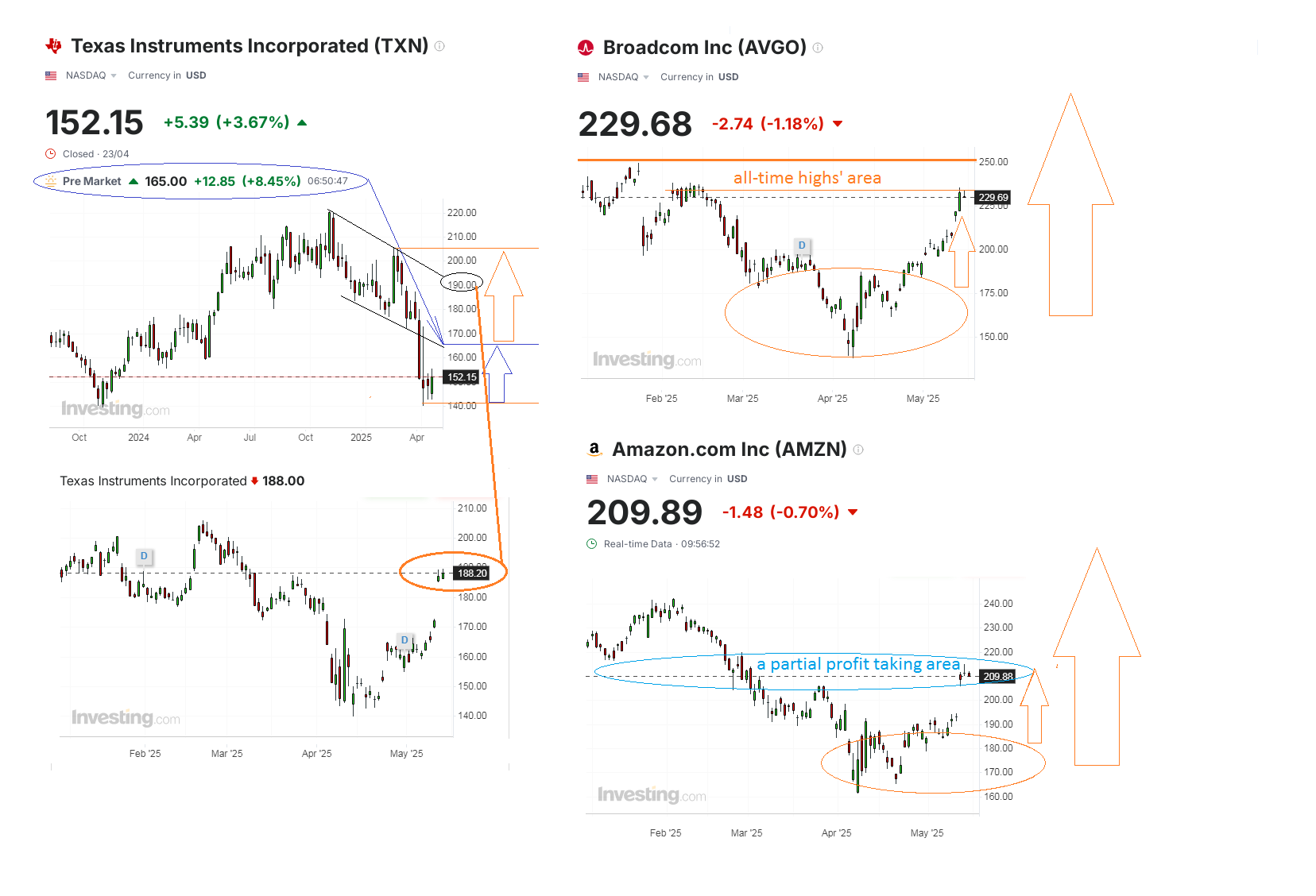

In particular, I should mention here Texas Instruments (TXN), a chipmaker, which I collected for my personal investment portfolio at $165 per share after a very impressive earnings report only three weeks ago, being very confident in its growth prospects. That time, I pointed to a minor downtrend line between $190 and $195 as the lowest medium-term target (see the chart from April 24, which I reproduce here again). The TXN price rally of 14% to $188 has already happened, and I see the point in taking profits on at least 2/3 of the initial trade size, leaving the remaining 1/3 for targets above $200 if higher price peaks would be reached later. Among my darling assets that I have written about more than once as integral parts of my trading strategy, I would mention Tesla (TSLA), Broadcom (AVGO), Meta Platforms (META) and, of course, Amazon (AMZN), which I have characterised many times as more promising than Apple (APPL). As one can see, Apple fell down worse than many others, but also bounced significantly on the news of Trump's deal with China. However, I still trust Apple's future returns less than in cases of Amazon and all other tech giants listed above.

Even though my ultimate price targets for Amazon are definitely well above $250, I am still going to collect some of the stones before the end of this week (selling half of previously opened positions), at around $210 each, or maybe little better if possible, since current price ranges may persist here for a long time. And I'll definitely do the same thing with my Broadcom (AVGO) stake, as the recent rally to $235 from very deep lows of around $145 just in early April looks like maybe overperforming to some extent, and past historical highs are looming just above $250. As for Meta and Tesla investment cases, I will not get rid of any shares for now, and will hold the entire purchases in reserve until even better times, since targets of over $750 for Meta and at least $450, if not $500, for Tesla are still a long way off. We could also talk about crypto stories, but this is probably worth dedicating a separate article.

All that panic was clearly for naught four or five weeks ago, but I was never worried. Wise people should buy lows at such moments. Trump-tracking trade never fails. Successively cutting through the noise like tariff and recession fears, our common sense guided us with clear recommendations to buy what was temporarily cheap yet of good quality, thanks to a solid fundamental ground behind those assets. That was also a process of separating proper wheat from the chaff, in other words, so that in the light of the bullish momentum it became much more clear which stocks were actually worthy of picking up and which were rightly left aside with their delayed growth. Well, if you were by my side in this spring market, then all of us have made very good money on picking up Wall Street favourite stocks. Anyway, everyone has made his or her own conclusions for the coming months. Me too, and so I am going to continue sharing conclusions and fresh trading ideas of mine here, with your kind permission, of course.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.