- Metadoro

- Markets

- Currencies

- GBPUSD - Great Britain Pound to US Dollar

GBPUSD GBP/USD

Great Britain Pound to US Dollar

Great Britain Pound to US Dollar

- By date

- Metadoro first

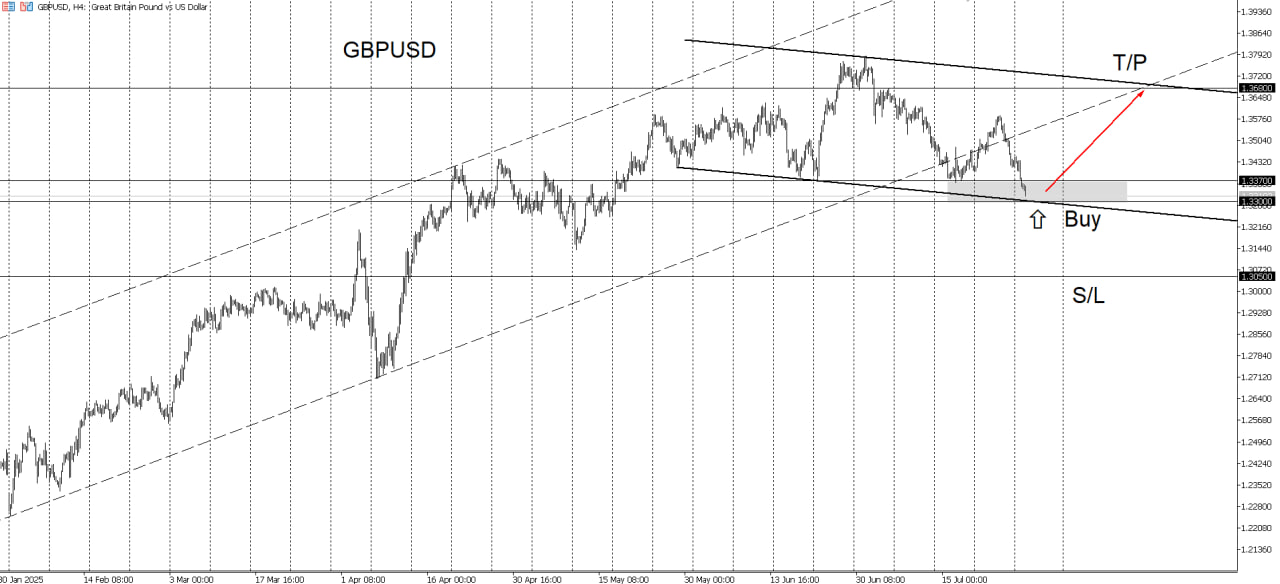

The GBPUSD had been in a steady uptrend since January 13, climbing by 10% to reach 1.33260, with a peak at 1.37870 on July 1. Recently, however, the pair experienced a sharp correction, breaking below the established uptrend support. While this move may appear to signal accelerating downside momentum, the reality is more neutral. Rather than continuing to fall, the pair has settled into a sideways consolidation, holding above a strong support level at 1.33000. This suggests the current weakness is more of a pause than a reversal. The likely next move is a bounce toward 1.36500–1.37000. In this context, opening a long position between 1.33000 and 1.33700 appears reasonable, with a target at 1.36800 and a stop-loss set at 1.30500.

Great Britain Pound to US Dollar

- Brokers usually offer best conditions for traders to trade GBP/USD with minor spreads and fees. The pair sometimes has positive swaps that can be used to get some more profit;

- Trading is accompanied by huge liquidity. Thus, the pair is very “technical,” meaning that technical analysis could be exercised with high accuracy. Thus, it is very popular among individual traders;

- Moving factors behind the USD are stronger and play a decisive role in the pair’s movements. Thus, dollar-related drivers should be monitored very carefully, including the actions of the U.S. Federal Reserve;

- Macroeconomic data in the United Kingdom, like Gross Domestic Product (GDP), inflation, the Purchasing Manager’s Index (PMI), unemployment, and the actions of the Bank of England, move the pair from the Pound’s side;

- The Pound is not a commodity-driven currency, neither is it a safe haven asset. Thus, changes in risk appetite have minor effects on the pair from the Pound’s side; - The Cable is heavily linked to the Euro as the British economy has vast exposure to Europe. Financial services in the U.K. are also bound to Europe. However, neither currency plays a leading role here. Any currency can take this role depending on the market situation;

- European and American hours are the most favorable to trade the Cable, or cross rates with the Pound. Trading on the Pound drops during night hours and is subject to minor volatility.

| Ticker | GBPUSD GBP/USD |

| Contract value | 100000 GBP |

| Maximum leverage | 1:500 |

| Date | Short Swap (pips) | Long Swap (pips) | No data |

|---|

| Minimum transaction volume | 0.01 lot |

| Maximum transaction volume | 100 lots |

| Hedging margin | 50% |

| USD Exposure | Max Leverage Applied | Floating Margin |

|---|