News and analysis

Tezos (XTZ) has declined slightly by 0.2% this week, trading at $1.249, following Bitcoin’s (BTC) drop to $89,158, which triggered widespread altcoin sell-offs due to concerns of a potential further decline in BTC to $80,000. However, Bitcoin managed to hold above the critical support level at $89,000-$91,000, offering some relief to the broader crypto market.

Speculation about a shift in U.S. trade policy has provided additional support to crypto assets. Reports suggest the new U.S. administration may pursue a gradual increase in tariffs rather than an abrupt hike, which could help alleviate inflationary pressures and lead to a less aggressive monetary stance from the Federal Reserve.

This development is a positive signal for the cryptocurrency market and may help Tezos maintain its position above the key support level of $1.200.

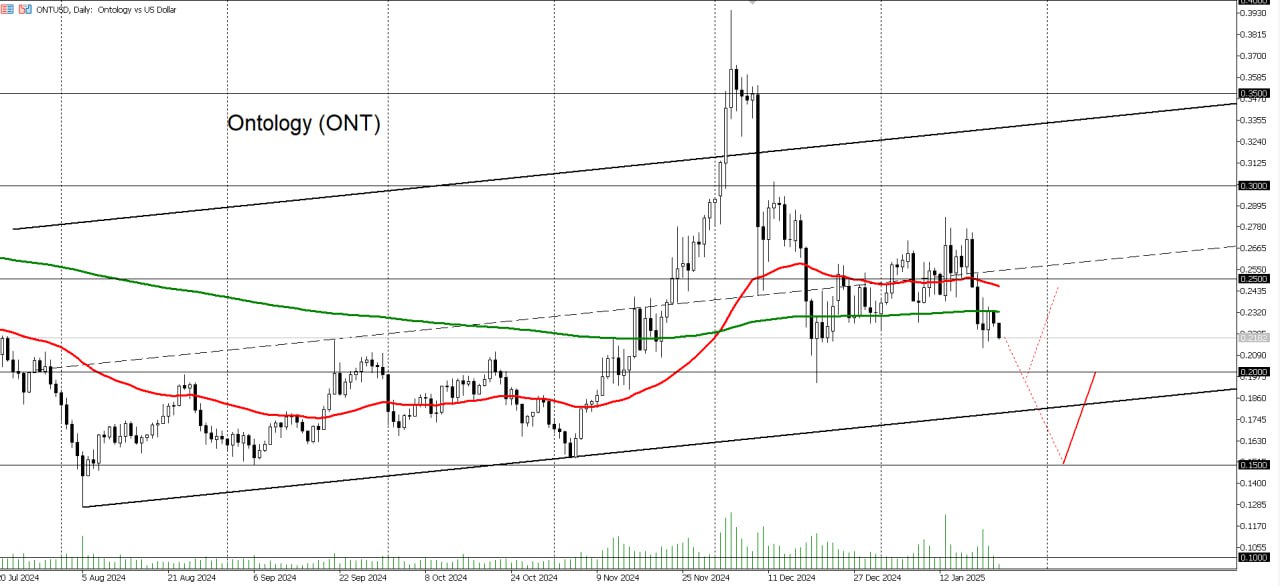

Ontology (ONT) is down 2.3% this week, trading at $0.2176, in line with the broader crypto market where Bitcoin (BTC) has declined 2.0% to $101,632. While the new U.S. administration has made some strides toward fairer crypto regulation, Donald Trump has remained silent on the highly anticipated issue of adding Bitcoin to U.S. federal reserves.

Market speculation is rampant, with figures like BlackRock CEO Larry Fink suggesting Bitcoin could surge to $700,000 per coin if sovereign wealth funds begin accumulating. Other forecasts predict Bitcoin reaching $250,000 by year-end. While such projections could foster optimism, the lack of decisive action or announcements regarding U.S. crypto reserves is weighing heavily on the market.

For Ontology, the situation remains bearish. Having breached the critical support at $0.2500 last week, the token is now approaching the $0.2000 level. A failure to provide clear evidence or statements about U.S. federal crypto reserve plans could see ONT fall even further, breaching the $0.2000 mark and deepening its losses.

Delta Air Lines stock rose markedly by low double digits in the first ten days of the new year. The U.S. carrier has served more than 200 million customers in 2024, when it was also recognized by J.D. Power, a leading American data analytics and consumer intelligence company, for being No. 1 in First/Business and Premium Economy Passenger Satisfaction. Travelers became more willing to spend extra money for swanky seats when meeting a high level of service. Delta is just positioning itself as the nation's premium airline. And what's more important, its Christmas quarter's earnings reportedly surpassed average analyst pool projections. Driven by stronger travel demand, smart financial management and capacity discipline, Delta business provided last three-months' profit of $1.85 per share vs $1.28 at the same period one year ago, compared to $1.75 in consensus estimates. On January 10, the airline industry leader put its future profit levels within a range between $0.70 and $1 per share in the current quarter through the end of March, while analyst expectations were focused on $0.77 cents, according to data compiled by LSEG. The starting months of each year always perform worse. It is clear that all carriers made losses in the Covid years of 2020-2022, but Delta profits only recovered into a range from $0.25 to $0.45 in the first quarter of 2023 and 2024, respectively, but Q1 profit numbers varied from $0.75 to $0.96 even in the three blessed years before the pandemic. Delta added that it is forecasting annual earnings in excess of $7.35 a share, which would be the highest in its 100-year history, based on its planned revenue growth of 7% to 9% in the March quarter from a year ago. The announcement could be compared to an adjusted profit of $6.16 a share in 2024. The company happily breaks through ticket prices' rising effects, almost undisturbed by a reduction in airline seats in the domestic market, which was peculiar for most carriers. Thus, new expectations created a fertile ground for setting new price records, even though price movements on Delta charts look most convincing among its other American rivals.

By the way, Citigroup analysts freshly updated their outlook on Delta Air Lines shares to raise their price target to $80 from the previous $77, vs the actual range around $65 per share where the stock just came after a reasonable market correction from last week's and all-time highs. Citigroup said it has included factors like higher revenue per available seat mile, projections of slightly lower fuel prices, increased taxation, a minor rise in share count, and the incorporation of fourth-quarter 2024 results into their financial model, which has projected Delta's profit at $7.49 per share in 2024 and $8.72 in 2025. Delta shares are Buy-rated at Citi, and we agree with their positive estimates in general, while keeping in mind even better price goals somewhere between $82.5 and $85.

VeChain (VET) has fallen 12.7% this week, trading at $0.0445, underperforming the broader cryptocurrency market. Bitcoin (BTC), the leading cryptocurrency, has declined by 5.6% to $93,220, with bearish momentum building as it approaches key support at $89,000-$91,000. This decline is largely attributed to tightening monetary conditions in the United States, which continue to weigh on risk assets. Investor confidence is further shaken by significant net outflows from spot BTC-ETFs, which lost $583 million on Wednesday, marking the second-largest single-day outflow on record.

If BTC falls below the critical support level of $89,000-$91,000, VeChain is likely to extend its losses, with prices potentially declining another 10% to $0.0400. A sustained drop in BTC could push VET even lower, towards $0.0300. Conversely, a strong rebound in BTC prices to the $100,000 level could drive VET back up to $0.0500, representing a recovery of approximately 12% from current levels.

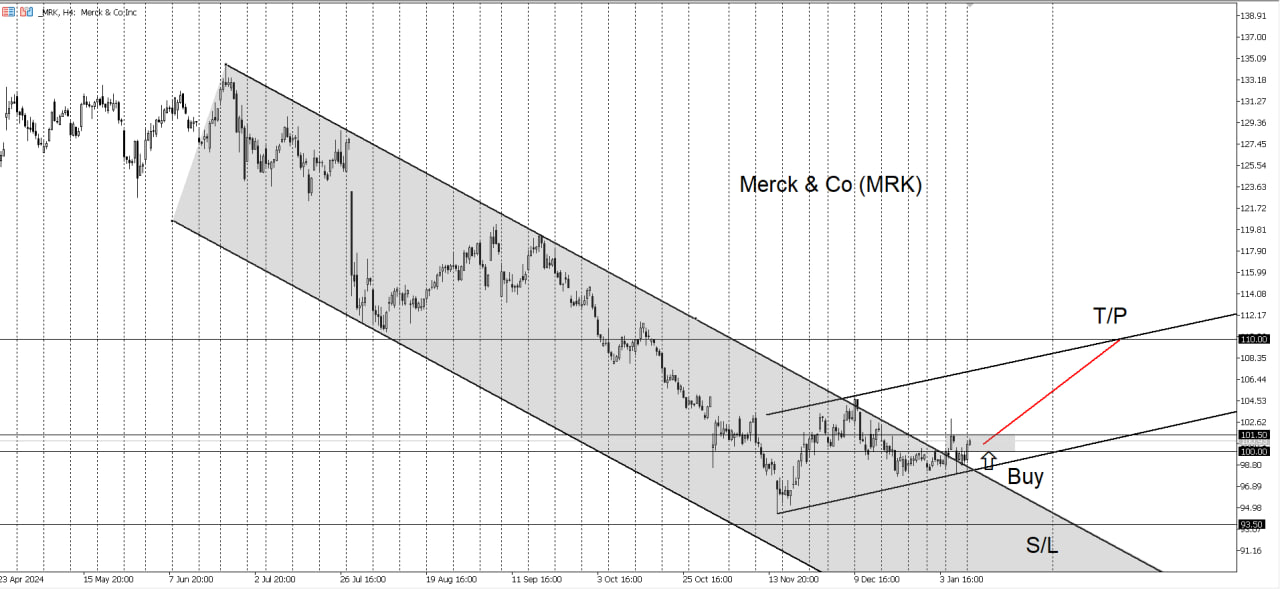

Merck & Co (MRK) stocks have shown signs of becoming a compelling buy opportunity. Over the past six months, the stock has been in a downtrend, declining 29.8% to $94.50 per share. However, since mid-November, MRK has demonstrated a reversal of momentum, rebounding by 10.0% to reach $104.87 on December 5. Following a brief pullback and consolidation period, the stock has retested the downtrend resistance and appears poised to continue its upward trajectory.

With prices currently positioned to target $110.00, this represents a potential 9-10% upside from the present levels. Setting a stop-loss at $93.50 aligns with a prudent risk management strategy, providing protection against further downside while allowing for upside potential. The recent consolidation phase further supports the case for a breakout, making this an attractive moment to consider initiating or adding to a position in MRK.